I fail to see how this can happen without the rupee being a fully convertible currency. Even the RMB cannot be a trade currency as it is not fully convertible. I don't think the govt is ready to make the Rupee fully convertible without restrictions.uddu wrote: ↑24 Oct 2025 09:32 Cross posting from Modi 3.0

India’s Big Push: Turning the Rupee Into a Global Currency Amid Trump’s Tariff Shock

— turning the rupee into a global trade currency. From new RBI exchange rate mechanisms and Vostro accounts abroad, to rupee settlement clauses in future trade pacts — I

Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Re: Indian Economy News & Discussion - Nov 27 2017

Global trade currency without full convertibility? I agree, it can't happen.

However:

However:

Out of these 23, AI claims:India has finalized currency swap arrangements with 23 countries, enabling trade in local currencies and reducing reliance on the US dollar

These countries have agreed to or are currently using the Indian rupee for trade settlements:

Russia – Rupee trade surged post-sanctions, with Vostro accounts facilitating direct settlements

Sri Lanka – Facing forex shortages, Sri Lanka uses rupee for imports and services

Mauritius – Engaged in rupee-based trade and financial cooperation

UAE – RBI is setting direct rupee-dirham reference rates to enable smoother trade

Indonesia – Similar arrangements underway with rupiah-rupee reference rates

Germany – Among the 18 countries approved for rupee trade

Kenya – Included in RBI’s list for rupee settlement

Singapore – Active participant in rupee-based transactions

UK – Approved for rupee trade under RBI’s framework

Re: Indian Economy News & Discussion - Nov 27 2017

India’s manufacturing PMI hits 2-month high at 58.4 in Oct

https://ianslive.in/indias-manufacturin ... 1024111938

https://ianslive.in/indias-manufacturin ... 1024111938

New Delhi, Oct 24 (IANS) India’s manufacturing activity showed renewed strength in October, with the HSBC Flash India Manufacturing Purchasing Managers’ Index (PMI) rising to a two-month high of 58.4, up from 57.7 in September, a report showed on Friday.

The data compiled by S&P Global indicates that the country’s manufacturing sector continues to expand at a solid pace, supported by strong domestic demand and easing cost pressures.

The rise in the manufacturing PMI reflects an improvement in business conditions, driven by higher new orders, increased production, and steady employment levels.

Re: Indian Economy News & Discussion - Nov 27 2017

These are all interesting claims. However, we import materials from Germany, Indonesia, UK and Singapore from the list below. Everything is priced in USD, GBP or Euro. Even singapore companies quote only in USD for stuff.

So maybe all this stuff is only happening in G2G deals, i have never seen any of this INR trade happening in private deals.

It would be nice to see this happen, but, i would doubt anyone taking INR without full convertibility.

So maybe all this stuff is only happening in G2G deals, i have never seen any of this INR trade happening in private deals.

It would be nice to see this happen, but, i would doubt anyone taking INR without full convertibility.

A_Gupta wrote: ↑24 Oct 2025 13:23 Global trade currency without full convertibility? I agree, it can't happen.

However:Out of these 23, AI claims:India has finalized currency swap arrangements with 23 countries, enabling trade in local currencies and reducing reliance on the US dollar

These countries have agreed to or are currently using the Indian rupee for trade settlements:

Russia – Rupee trade surged post-sanctions, with Vostro accounts facilitating direct settlements

Sri Lanka – Facing forex shortages, Sri Lanka uses rupee for imports and services

Mauritius – Engaged in rupee-based trade and financial cooperation

UAE – RBI is setting direct rupee-dirham reference rates to enable smoother

Indonesia – Similar arrangements underway with rupiah-rupee reference rates

Germany – Among the 18 countries approved for rupee trade

Kenya – Included in RBI’s list for rupee settlement

Singapore – Active participant in rupee-based transactions

UK – Approved for rupee trade under RBI’s framework

Re: Indian Economy News & Discussion - Nov 27 2017

https://businessviewpointmagazine.com/r ... -accounts/

Baby steps.

This is since July 2022, I think.Since the introduction of RBI Rupee Accounts, India has settled transactions worth ₹1.34 lakh crore (approximately $16 billion) directly in rupees.

Baby steps.

Re: Indian Economy News & Discussion - Nov 27 2017

https://x.com/EverythingAjay/status/1982390120801317132

@EverythingAjay

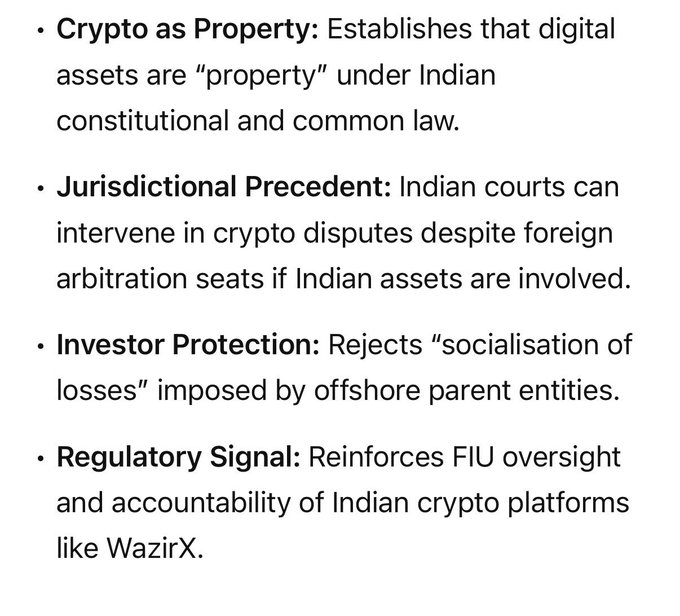

Before RBI or FM made a move…a High Court just legalizes crypto

For 5 years, crypto in India floated between commodity & currency

Now it’s officially PROPERTY

That one word changes everything

Exchanges can now be sued in civil courts, not just under IT Act offences

@EverythingAjay

Before RBI or FM made a move…a High Court just legalizes crypto

For 5 years, crypto in India floated between commodity & currency

Now it’s officially PROPERTY

That one word changes everything

Exchanges can now be sued in civil courts, not just under IT Act offences

Re: Indian Economy News & Discussion - Nov 27 2017

https://x.com/ShamikaRavi/status/1982306634841125332

@ShamikaRavi

This has been an open secret in the economics profession for decades. Several instances come to mind. Here’s one from the editor of an ‘A’ journal in 2009: “This is very good work, your model is neat and the empirical approach is novel. Unfortunately the data is from India, so not generalizable.”(!!)

Lesson: we need more of our own journals & thank god for open source.

https://x.com/heimbergecon/status/1981614234409550210

@heimbergecon

This paper shows that authors from low-income countries remain excluded from top-ranked economics journals and receive less attention from other economists. Developing country authors are far less likely to be published in top journals even when holding citation counts constant.

@ShamikaRavi

This has been an open secret in the economics profession for decades. Several instances come to mind. Here’s one from the editor of an ‘A’ journal in 2009: “This is very good work, your model is neat and the empirical approach is novel. Unfortunately the data is from India, so not generalizable.”(!!)

Lesson: we need more of our own journals & thank god for open source.

https://x.com/heimbergecon/status/1981614234409550210

@heimbergecon

This paper shows that authors from low-income countries remain excluded from top-ranked economics journals and receive less attention from other economists. Developing country authors are far less likely to be published in top journals even when holding citation counts constant.

Re: Indian Economy News & Discussion - Nov 27 2017

Question - the news is that an increasing amount of India's Foreign Currency Assets are in gold and less in dollars.

But the RBI can buy gold in rupees on the domestic market. Since gold is fungible, India can build up Foreign Currency Assets domestically.

Why hasn't this been done before?

But the RBI can buy gold in rupees on the domestic market. Since gold is fungible, India can build up Foreign Currency Assets domestically.

Why hasn't this been done before?

Re: Indian Economy News & Discussion - Nov 27 2017

https://x.com/NewsAlgebraIND/status/1983572991603806674

@NewsAlgebraIND

BIG BREAKING NEWS RBI brings 64 tonnes of gold back to India from UK vaults between March and September 2025

In 1991, India had to ship out gold overnight amidst the financial crisis.

Since March 2023, a total of 274 tonnes has been repatriated to India’s vaults

Over two-thirds of RBI’s gold reserves are now stored within the country.

This move strengthens India’s financial security and reduces dependence on foreign custodians.

@NewsAlgebraIND

BIG BREAKING NEWS RBI brings 64 tonnes of gold back to India from UK vaults between March and September 2025

In 1991, India had to ship out gold overnight amidst the financial crisis.

Since March 2023, a total of 274 tonnes has been repatriated to India’s vaults

Over two-thirds of RBI’s gold reserves are now stored within the country.

This move strengthens India’s financial security and reduces dependence on foreign custodians.

Re: Indian Economy News & Discussion - Nov 27 2017

https://x.com/IMFNews/status/1984062830996549882

@IMFNews

Our new analysis in the Global Financial Stability Report reveals that in emerging economies, greater domestic ownership of local currency debt reduces the impact from global shocks, and bond yields rise less than they would otherwise amid turbulence

@IMFNews

Our new analysis in the Global Financial Stability Report reveals that in emerging economies, greater domestic ownership of local currency debt reduces the impact from global shocks, and bond yields rise less than they would otherwise amid turbulence

Re: Indian Economy News & Discussion - Nov 27 2017

What do you see as the goal of swapping a non-inflationary item (personal gold holdings) with an inflationary one (cash) in the hands of the consumer without backing it with actual productive assets or work ?A_Gupta wrote: ↑30 Oct 2025 08:20 Question - the news is that an increasing amount of India's Foreign Currency Assets are in gold and less in dollars.

But the RBI can buy gold in rupees on the domestic market. Since gold is fungible, India can build up Foreign Currency Assets domestically.

Why hasn't this been done before?

Re: Indian Economy News & Discussion - Nov 27 2017

No goal; I was just struck that the RBI could raise "foreign reserves" without any outside-of-India trading, simply by buying gold in the domestic market. In principle, it could have done so in 1991, too, when India had that crisis.Suraj wrote: ↑31 Oct 2025 23:46What do you see as the goal of swapping a non-inflationary item (personal gold holdings) with an inflationary one (cash) in the hands of the consumer without backing it with actual productive assets or work ?A_Gupta wrote: ↑30 Oct 2025 08:20 Question - the news is that an increasing amount of India's Foreign Currency Assets are in gold and less in dollars.

But the RBI can buy gold in rupees on the domestic market. Since gold is fungible, India can build up Foreign Currency Assets domestically.

Why hasn't this been done before?

Re: Indian Economy News & Discussion - Nov 27 2017

There's quite a bit of history in other countries where that has been tried.

Executive Order 6102

These days, a visit to India means you can pay for your trip by hauling back dirt cheap high quality merchandise sold in India as part of your personal baggage. Far cry from the 1991 days where India struggled to make goods that others would buy.

Aside from structural reform that allowed production, the competitive price is made possible by a devaluation of the currency similar to what happened in the other instances where governments bought gold from their population to shore up reserves.

Executive Order 6102

These days, a visit to India means you can pay for your trip by hauling back dirt cheap high quality merchandise sold in India as part of your personal baggage. Far cry from the 1991 days where India struggled to make goods that others would buy.

Aside from structural reform that allowed production, the competitive price is made possible by a devaluation of the currency similar to what happened in the other instances where governments bought gold from their population to shore up reserves.

-

nandakumar

- BRFite

- Posts: 1691

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Nov 27 2017

The gold currently held by the RBI is only a seventh of what it holds as foreign currency assets. And also as Suraj pointed out, it doesn't contribute readily to financing our Foreign Currency transactions for purchase of goods and services or repayment of loans (both private and government). In 1991 when financial situation was dire, we had to borrow against pledge of gold, the lenders insisted that the official gold held by RBI be physically transferred to vaults in London.A_Gupta wrote: ↑30 Oct 2025 08:20 Question - the news is that an increasing amount of India's Foreign Currency Assets are in gold and less in dollars.

But the RBI can buy gold in rupees on the domestic market. Since gold is fungible, India can build up Foreign Currency Assets domestically.

Why hasn't this been done before?

Currently our foreign liabilities are higher than foreign currency reserves plus gold.

https://rbidocs.rbi.org.in/rdocs/Wss/PD ... 49D2B9.PDF

-

nandakumar

- BRFite

- Posts: 1691

- Joined: 10 May 2010 13:37

Re: Indian Economy News & Discussion - Nov 27 2017

The gold currently held by the RBI is only a seventh of what it holds as foreign currency assets. And also as Suraj pointed out, it doesn't contribute readily to financing our Foreign Currency transactions for purchase of goods and services or repayment of loans (both private and government). In 1991 when financial situation was dire, we had to borrow against pledge of gold, the lenders insisted that the official gold held by RBI be physically transferred to vaults in London.A_Gupta wrote: ↑30 Oct 2025 08:20 Question - the news is that an increasing amount of India's Foreign Currency Assets are in gold and less in dollars.

But the RBI can buy gold in rupees on the domestic market. Since gold is fungible, India can build up Foreign Currency Assets domestically.

Why hasn't this been done before?

Currently our foreign liabilities are higher than foreign currency reserves plus gold.

https://rbidocs.rbi.org.in/rdocs/Wss/PD ... 49D2B9.PDF

Re: Indian Economy News & Discussion - Nov 27 2017

Piyush Goyal on India-US deal: What's important is competitive advantage ... tariffs paid Americans

Union Minister Piyush Goyal highlights India’s robust

trade and export growth, ongoing advanced trade talks

with the EU and US, and efforts to support startups and

innovation. He also notes progress in India-China

engagement post-Galwan, with diplomatic visits and SCO

Summit discussions aiming for normalised relations,

marking an exciting phase in India’s Amritkaal journey.

Union Minister Piyush Goyal highlights India’s robust

trade and export growth, ongoing advanced trade talks

with the EU and US, and efforts to support startups and

innovation. He also notes progress in India-China

engagement post-Galwan, with diplomatic visits and SCO

Summit discussions aiming for normalised relations,

marking an exciting phase in India’s Amritkaal journey.

Re: Indian Economy News & Discussion - Nov 27 2017

RBI buying domestic gold and exchanging it with currency in circulation, or just bond issuances, is not 'foreign reserves'. While the gold itself may be fungible, balance sheets are not - some of that gold will count as part of forex reserves and the rest will be domestic.

Re: Indian Economy News & Discussion - Nov 27 2017

Thanks @Suraj, @vera_k, @nandakumar!

Re: Indian Economy News & Discussion - Nov 27 2017

The Goods and Services Tax (GST) collections witnessed a 4.6% year-on-year (YoY) growth to ₹1.96 trillion in October 2025, despite the tax cuts rolled out by the central government's GST Council in September.

https://www.livemint.com/economy/indias ... 97963.html

https://www.livemint.com/economy/indias ... 97963.html

Re: Indian Economy News & Discussion - Nov 27 2017

The FTA was always bad.

A lot of Chinese stuff being rebranded in smaller ASEAN countries at discounted import duties comes to India and we got precious little in return.

Good that it’s being reviewed.

ASEAN has been stalling it for a long time.

We need way more from ASEAN than the one sided FTA allows

No wonder that youanus wants bangladesh to become a full member of ASEAN and has actively sought support from member countries like malaysia.

The beedis first applied for primary status in 2020.

The beedis aim to bridge south asia and ASEAN.

One remains doubtful if such an agenda would ever come true

A lot of Chinese stuff being rebranded in smaller ASEAN countries at discounted import duties comes to India and we got precious little in return.

Good that it’s being reviewed.

ASEAN has been stalling it for a long time.

We need way more from ASEAN than the one sided FTA allows

No wonder that youanus wants bangladesh to become a full member of ASEAN and has actively sought support from member countries like malaysia.

The beedis first applied for primary status in 2020.

The beedis aim to bridge south asia and ASEAN.

One remains doubtful if such an agenda would ever come true

Re: Indian Economy News & Discussion - Nov 27 2017

India fuels billions in revenue for global tech giants like whatsApp, facebook, youtube & amazon and emerging trends may give India a chance to reclaim this value.

Re: Indian Economy News & Discussion - Nov 27 2017

Source: fortune.Com

Re: Indian Economy News & Discussion - Nov 27 2017

For those interested .. a nice graphic of rare earths

Source: mining.Com

Source: mining.Com

-

Mukesh.Kumar

- BRFite

- Posts: 1440

- Joined: 06 Dec 2009 14:09

Re: Indian Economy News & Discussion - Nov 27 2017

India's US exports jump despite 50% tariffs as trade tensions ease PeePeeSee Link

Apparently, it's a month-on-month growth and remains to be seen firstly, if the growth is at net exports level, and if so, which sectors are driving the growth. But for the moment, this is a spot of good news.

Apparently, it's a month-on-month growth and remains to be seen firstly, if the growth is at net exports level, and if so, which sectors are driving the growth. But for the moment, this is a spot of good news.

Re: Indian Economy News & Discussion - Nov 27 2017

The unnecessary glorification of India-US ties need to be done away with. China does so much trade with China even after Xi never opening his mouth and the Chinese threatening the U.S.

India As A Nation Has To Secure Its Interests; No Hiatus In India-US Relationship: Piyush Goyal

India-US Trade Ties | Commerce Minister Piyush Goyal says

No hiatus in the India-US relationship

India as a nation has to secure its interests

You will hear good news when the deal becomes equitable & balanced

India As A Nation Has To Secure Its Interests; No Hiatus In India-US Relationship: Piyush Goyal

India-US Trade Ties | Commerce Minister Piyush Goyal says

No hiatus in the India-US relationship

India as a nation has to secure its interests

You will hear good news when the deal becomes equitable & balanced

Re: Indian Economy News & Discussion - Nov 27 2017

https://m.youtube.com/shorts/Um2OFHJHMds

Humanoid robots .. game changer and a paradigm shift

how soon ? Sooner than we think .. musk s trillion dollar handout !

How is this going to affect economies ?

China s future factories are ikely to be fully robotised dark factories

Can an economy relying on cheap labour compete ?

AI revolution can obliterate human involvement in most industries

How does services industry compete with the AI onslaught?

Humanoid robots .. game changer and a paradigm shift

how soon ? Sooner than we think .. musk s trillion dollar handout !

How is this going to affect economies ?

China s future factories are ikely to be fully robotised dark factories

Can an economy relying on cheap labour compete ?

AI revolution can obliterate human involvement in most industries

How does services industry compete with the AI onslaught?

Re: Indian Economy News & Discussion - Nov 27 2017

Cross posting from Modi 3.0

India–Israel partnership deepens as Piyush Goyal, his Israeli counterpart sign ToR for FTA

Union Minister Piyush Goyal and his Israeli counterpart Nir Barkat sign Terms of Reference (ToR) for Free Trade Agreement between India and Israel.

India–Israel partnership deepens as Piyush Goyal, his Israeli counterpart sign ToR for FTA

Union Minister Piyush Goyal and his Israeli counterpart Nir Barkat sign Terms of Reference (ToR) for Free Trade Agreement between India and Israel.

Re: Indian Economy News & Discussion - Nov 27 2017

FWIW

BREAKING: The $610 Billion AI Ponzi Scheme Just Collapsed

Last night at 4pm EST, something unprecedented happened. Nvidia stock rallied 5% on earnings, then crashed into negative territory within 18 hours. Wall Street algorithms detected what humans couldn’t: the numbers don’t add up.

Here’s what they found.

Nvidia reported $33.4 billion in unpaid bills, up 89% in one year. Customers who bought chips haven’t paid for them yet. The average wait time for payment stretched from 46 days to 53 days. That extra week represents $10.4 billion that may never arrive.

Meanwhile, Nvidia stockpiled $19.8 billion in unsold chips, up 32% in three months. But management claims demand is insane and supply is constrained. Both cannot be true. Either customers aren’t buying or they’re buying without cash.

The cash flow tells the real story. Nvidia generated $14.5 billion in actual cash but reported $19.3 billion in profit. The gap is $4.8 billion. Healthy chip companies like TSMC and AMD convert over 95% of profits to cash. Nvidia converts 75%. That’s distress level.

Here’s where it gets criminal.

Nvidia gave $2 billion to xAI. xAI borrowed $12.5 billion to buy Nvidia chips. Microsoft gave OpenAI $13 billion. OpenAI committed $50 billion to buy Microsoft cloud. Microsoft ordered $100 billion in Nvidia chips for that cloud. Oracle gave OpenAI $300 billion in cloud credits. OpenAI ordered Nvidia chips for Oracle data centers.

The same dollars circle through different companies and get counted as revenue multiple times. Nvidia books sales, but nobody actually pays. The bills age. The inventory piles up. The cash never comes.

AI company CEOs admitted it themselves last week. Airbnb’s CEO called it vibe revenue. OpenAI burns $9.3 billion per year but makes $3.7 billion. That’s a $5.6 billion annual loss. The $157 billion valuation requires $3.1 trillion in future profits that MIT research shows 95% of AI projects will never generate.

Peter Thiel sold $100 million in Nvidia on November 9. SoftBank dumped $5.8 billion on November 11. Michael Burry bought put options betting Nvidia crashes to $140 by March 2026.

Bitcoin, which tracks AI speculation, dropped from $126,000 in October to $89,567 today. That’s a 29% crash. AI startups hold $26.8 billion in Bitcoin as collateral for loans. When Nvidia falls another 40%, those loans default, forcing $23 billion in Bitcoin sales, crashing crypto to $52,000.

The timeline is now certain. February 2026, Nvidia reports fourth quarter and reveals how many bills aged past 60 days. March 2026, credit agencies downgrade. April 2026, the first restatement. The fraud that took 18 months to build unwinds in 90 days.

Fair value for Nvidia: $71 per share. Current price: $186. The math is simple.

This is the fastest moving financial fraud in history because algorithms detected it in real time. Human investors are 90 days behind.

Source : https://x.com/shanaka86/status/1991496690537492837

BREAKING: The $610 Billion AI Ponzi Scheme Just Collapsed

Last night at 4pm EST, something unprecedented happened. Nvidia stock rallied 5% on earnings, then crashed into negative territory within 18 hours. Wall Street algorithms detected what humans couldn’t: the numbers don’t add up.

Here’s what they found.

Nvidia reported $33.4 billion in unpaid bills, up 89% in one year. Customers who bought chips haven’t paid for them yet. The average wait time for payment stretched from 46 days to 53 days. That extra week represents $10.4 billion that may never arrive.

Meanwhile, Nvidia stockpiled $19.8 billion in unsold chips, up 32% in three months. But management claims demand is insane and supply is constrained. Both cannot be true. Either customers aren’t buying or they’re buying without cash.

The cash flow tells the real story. Nvidia generated $14.5 billion in actual cash but reported $19.3 billion in profit. The gap is $4.8 billion. Healthy chip companies like TSMC and AMD convert over 95% of profits to cash. Nvidia converts 75%. That’s distress level.

Here’s where it gets criminal.

Nvidia gave $2 billion to xAI. xAI borrowed $12.5 billion to buy Nvidia chips. Microsoft gave OpenAI $13 billion. OpenAI committed $50 billion to buy Microsoft cloud. Microsoft ordered $100 billion in Nvidia chips for that cloud. Oracle gave OpenAI $300 billion in cloud credits. OpenAI ordered Nvidia chips for Oracle data centers.

The same dollars circle through different companies and get counted as revenue multiple times. Nvidia books sales, but nobody actually pays. The bills age. The inventory piles up. The cash never comes.

AI company CEOs admitted it themselves last week. Airbnb’s CEO called it vibe revenue. OpenAI burns $9.3 billion per year but makes $3.7 billion. That’s a $5.6 billion annual loss. The $157 billion valuation requires $3.1 trillion in future profits that MIT research shows 95% of AI projects will never generate.

Peter Thiel sold $100 million in Nvidia on November 9. SoftBank dumped $5.8 billion on November 11. Michael Burry bought put options betting Nvidia crashes to $140 by March 2026.

Bitcoin, which tracks AI speculation, dropped from $126,000 in October to $89,567 today. That’s a 29% crash. AI startups hold $26.8 billion in Bitcoin as collateral for loans. When Nvidia falls another 40%, those loans default, forcing $23 billion in Bitcoin sales, crashing crypto to $52,000.

The timeline is now certain. February 2026, Nvidia reports fourth quarter and reveals how many bills aged past 60 days. March 2026, credit agencies downgrade. April 2026, the first restatement. The fraud that took 18 months to build unwinds in 90 days.

Fair value for Nvidia: $71 per share. Current price: $186. The math is simple.

This is the fastest moving financial fraud in history because algorithms detected it in real time. Human investors are 90 days behind.

Source : https://x.com/shanaka86/status/1991496690537492837

Last edited by drnayar on 21 Nov 2025 14:39, edited 1 time in total.

Re: Indian Economy News & Discussion - Nov 27 2017

Unfortunately many such American led chicken is going to come back to the roost next year.

Re: Indian Economy News & Discussion - Nov 27 2017

https://www.pib.gov.in/PressReleasePage ... ID=2192137

The combined Index of Eight Core Industries (ICI) in October 2025 has remained unchanged at 162.4 (provisional) as compared to the Index in October, 2024.

--- Is this signal of a slowdown?????

The combined Index of Eight Core Industries (ICI) in October 2025 has remained unchanged at 162.4 (provisional) as compared to the Index in October, 2024.

--- Is this signal of a slowdown?????

Re: Indian Economy News & Discussion - Nov 27 2017

India’s GDP to grow near 7% in FY26, economy resilient to global shocks: CEA V Anantha Nageswaran

Chief Economic Adviser V. Anantha Nageswaran said India’s economy has responded “quite satisfactorily” to global headwinds and is expected to record around 7% real GDP growth in FY26.

Speaking at the India Maritime Week, Nageswaran said India’s resilience, supported by government measures and RBI interventions, has placed the economy in a “comfortable position.”

He noted that three global rating agencies, including Standard & Poor’s, have recently upgraded India’s outlook, and the country could “soon move into the A rating category.”

The CEA credited tax reliefs, GST rationalisation, and fiscal prudence for strengthening India’s growth momentum. He also highlighted that total resource mobilisation has grown 28.5% annually over the past six years, indicating robust financial activity across sectors.

Nageswaran said India has achieved higher per capita income without adding to public debt and stressed that continued policy reforms and fiscal stability would sustain momentum.

Chief Economic Adviser V. Anantha Nageswaran said India’s economy has responded “quite satisfactorily” to global headwinds and is expected to record around 7% real GDP growth in FY26.

Speaking at the India Maritime Week, Nageswaran said India’s resilience, supported by government measures and RBI interventions, has placed the economy in a “comfortable position.”

He noted that three global rating agencies, including Standard & Poor’s, have recently upgraded India’s outlook, and the country could “soon move into the A rating category.”

The CEA credited tax reliefs, GST rationalisation, and fiscal prudence for strengthening India’s growth momentum. He also highlighted that total resource mobilisation has grown 28.5% annually over the past six years, indicating robust financial activity across sectors.

Nageswaran said India has achieved higher per capita income without adding to public debt and stressed that continued policy reforms and fiscal stability would sustain momentum.

Re: Indian Economy News & Discussion - Nov 27 2017

I'm looking forward to the new GDP revision on Feb 27 2026. It will update the base year to 2022-23 and that is just the beginning. It does a major revamp of the industrial sector, and accounts for a surprising amount of missing activity. For example, limited liability partnerships - several lakh companies - are excluded from GDP calculations today according to the recently provided details.

Re: Indian Economy News & Discussion - Nov 27 2017

It will also be the occasion for major whining by opposition parties that are more interested in bashing the ruling party coalition than the welfare of India.Suraj wrote: ↑22 Nov 2025 23:34 I'm looking forward to the new GDP revision on Feb 27 2026. It will update the base year to 2022-23 and that is just the beginning. It does a major revamp of the industrial sector, and accounts for a surprising amount of missing activity. For example, limited liability partnerships - several lakh companies - are excluded from GDP calculations today according to the recently provided details.

Seriously though, what estimated fraction of India's GDP is still unrecorded; and is there any statistics or graph showing the (hopefully shrinking) guesstimated fraction over time?

Re: Indian Economy News & Discussion - Nov 27 2017

I am surprised at the Dar Ka Mahol when one speaks about the Swadeshi movement and each time they have to explain it as not being substitute for imports. Where is this fear coming from? What will happen if it is indeed Import substitution? Even if you could generate more jobs doing so and ensure domestic market can absorb that what's the worry in making it, however small or big it is. Let the make it and compete in the global market and capture those markets monopolized by China and others. May be make a small change to the wording to "Competitive Swadeshi" and govt should say, you can replace anything in Indian and global market if you have the products, go and get it. If 100 percent Swadeshi, the better.

PM Modi's top economist demolishes Raghuram Rajan's 'Services, not manufacturing' argument

PM Modi's economist demolishes Raghuram Rajan's 'Services, not manufacturing' argument | @Visanalysis with Ankit Prasad

PM Modi's top economist demolishes Raghuram Rajan's 'Services, not manufacturing' argument

PM Modi's economist demolishes Raghuram Rajan's 'Services, not manufacturing' argument | @Visanalysis with Ankit Prasad

Re: Indian Economy News & Discussion - Nov 27 2017

Historic FTA Steps & $50B Metro Project: Piyush Goyal Reveals Next Big Trade Moves With Israel

This interview features Union Commerce Minister Piyush Goyal sharing insights from his transformative three-day visit to Israel in November 2025. He highlights the deepening bilateral ties, including the signing of the Terms of Reference to formally begin Free Trade Agreement negotiations. Goyal discusses promising collaborations in technology, agriculture, and innovation, emphasizing Israel’s advanced solutions such as drip irrigation and autonomous mobility. With projects like the $50 billion Tel Aviv Metro and plans to send skilled Indian workers, Goyal forecasts a significant boost in economic partnership and job creation between the two nations.

This interview features Union Commerce Minister Piyush Goyal sharing insights from his transformative three-day visit to Israel in November 2025. He highlights the deepening bilateral ties, including the signing of the Terms of Reference to formally begin Free Trade Agreement negotiations. Goyal discusses promising collaborations in technology, agriculture, and innovation, emphasizing Israel’s advanced solutions such as drip irrigation and autonomous mobility. With projects like the $50 billion Tel Aviv Metro and plans to send skilled Indian workers, Goyal forecasts a significant boost in economic partnership and job creation between the two nations.

Re: Indian Economy News & Discussion - Nov 27 2017

The 1905 Swadeshi Movement was a boycott of British goods.

Then there was the post-Independence import substitution which was aided by high tariffs or outright bans of the foreign-made goods.

Today’s Swadeshi is neither boycott nor import substitution but make-and-compete.

When changing the meaning of a term hallowed by history, it is not Dar ka Mahol but good sense to keep explaining.

Then there was the post-Independence import substitution which was aided by high tariffs or outright bans of the foreign-made goods.

Today’s Swadeshi is neither boycott nor import substitution but make-and-compete.

When changing the meaning of a term hallowed by history, it is not Dar ka Mahol but good sense to keep explaining.

Re: Indian Economy News & Discussion - Nov 27 2017

There is a hesitation or fear trying to explain as if Complete Swadeshikaran is something bad. Even though its difficult to achieve, as long as its based on competitive market based economy and not on Red tape Licence Raj, why should one fear. Instead should be proudly pushing for as much as Swadeshi as possible. Govt will give 100 percent support should be the attitude rather than if but, please not, that this. The confusion should be behind us. The intention and work to get things done is there in what they consider as strategic sectors. The unapologetic aggressiveness to get the maximum potential and keep pushing the boundary is not there across sectors.A_Gupta wrote: ↑23 Nov 2025 20:08 The 1905 Swadeshi Movement was a boycott of British goods.

Then there was the post-Independence import substitution which was aided by high tariffs or outright bans of the foreign-made goods.

Today’s Swadeshi is neither boycott nor import substitution but make-and-compete.

When changing the meaning of a term hallowed by history, it is not Dar ka Mahol but good sense to keep explaining.