Single or few years. Consistent is states like Mizoram from 2012 to 2024 with very good average.

https://statisticstimes.com/economy/ind ... growth.php

Indian states by GDP Growth

Source Ministry of Statistics and Programme Implementation (17)

Date 08 Sep 2025

Top Statistics

IPL 2025

List of continents by gdp per capita

Top 10 largest economies by GDP

See Also:

» GDP of Indian states

» GDP per capita growth of Indian states

» Comparing Indian states and Countries by GDP

» GDP-Population-Area relationship of Indian states

View More Economy Statistics

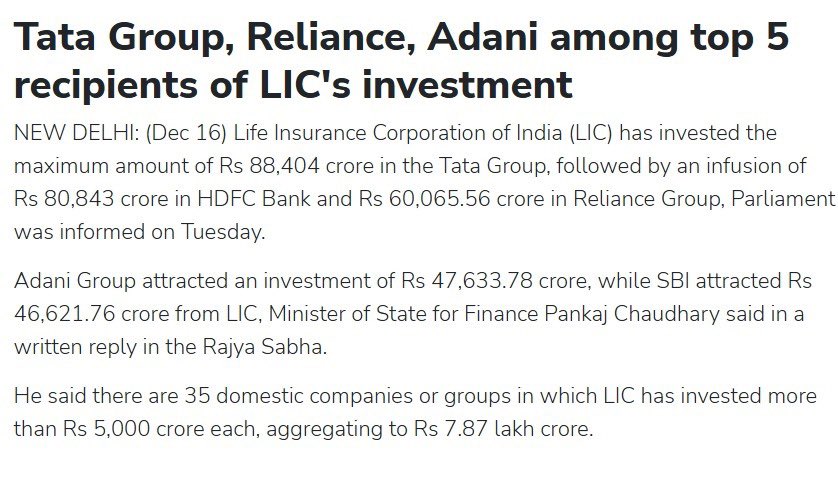

At constant 2011-12 prices, Tamil Nadu has attained the highest GSDP growth rate of 11.19%, followed by Arunachal Pradesh (9.66%), among 25 Indian states and union territories with data available for 2024-25. Eight states have a GDP growth rate above 8%, and 17 have a growth rate above 7%.

In the year 2023-24, Assam (12.00%) has the highest GSDP growth rate, followed by Bihar, Meghalaya, Nagaland, and Mizoram. The bottom five states, in reverse order, are Andaman & Nicobar Islands, Arunachal Pradesh, Karnataka, West Bengal, and Andhra Pradesh.

During the period 2012-24, Mizoram has the highest average growth rate of 9.78%, followed by Gujarat (8.32%). Only these two states have a GDP growth rate above 8%. Five states/UTs grew by an average of over 7 percent per year between fiscal years 2013 and 2024. The five slowest-growing states are Meghalaya (3.64%), Goa (4.12%), Puducherry (4.29%), Nagaland (4.55%), and West Bengal (4.59%).

At current prices, the top five states during 2012-24 are Mizoram, Sikkim, Madhya Pradesh, Karnataka, and Tripura. The bottom five states are Goa, Meghalaya, Puducherry, Punjab, and Uttarakhand.

https://rbi.org.in/Scripts/Publications ... ion=Annual

https://rbi.org.in/Scripts/AnnualPublic ... %20Economy

https://rbi.org.in/Scripts/AnnualPublic ... n%20States