Capitalism - it's painful, but it works

By Jeff Randall

After a year of grim financial news, it would be easy to dismiss the collapse of Lehman Brothers as just another bad day at the office. Easy, but wrong.

This is a rare defining moment, when regulators call the bluff of those who say that the demise of such an important bank will ruin our economic infrastructure. It is the day of reckoning.

In throwing Lehman to the dogs, US Treasury Secretary Hank Paulson is betting heavily that dire warnings of "contagion", "systemic risk" and "domino effect" are little more than special pleading from hitherto Masters of the Universe who would like the taxpayer to save their over-priced skins. It is quite a punt.

advertisementSoon enough we will discover if the core of Western finance is just an elaborate Ponzi scheme, underpinned only by new waves of suckers, or an imperfect but flexible machinery that, despite its flaws, has the capacity to withstand shocks.

Either way, it seems to me, Paulson was right to turn off the tap. If the system is rotten, why shore it up? If it's not, then it will - somehow - survive without more state aid.

The next test may not be far away. Right behind Lehman, in the departure lounge of life, is AIG, the giant insurance group, that lost $18.5 billion in the first nine months of this year.

Forget covering conventional risks such as hurricanes and floods, AIG was beguiled by the complexity of "credit default swaps" and is in urgent need of many billions to shore up its balance sheet. Yesterday the insurance regulator threw it a lifeline, but it remains on the critical list.

Lehman got what it deserved: to be the test case for a Darwinian shake-out. I fail to see why garbage collectors in Gloomsville should pay taxes so that $1,000-an-hour bankers can retain their seats at the Wall Street casino. They had their fun and they lost their chips. Correction, they lost other people's chips.

All right, so directors' share options are no longer worth anything, but all those jackpot bonuses have been banked - and they're not coming back. Lehman provides the latest egregious example of reward for failure.

Were it not so serious, the role reversal would be hilarious.

For years, US governments have called in titans of finance for advice on how to run federal affairs more effectively.

Now, those clever clogs who were once deemed to have all the answers are asking difficult questions, like: "May we have some help, please, we appear to have burned through our shareholders' reserves?"

What little faith I had in financial wizardry was blown away 10 years ago when Long Term Capital Management, a hedge fund set up by a couple of economists with Nobel Prizes in the cupboard, went pop. Lehman, I'm afraid, went the same way: bamboozling itself.

Over lunch at its Canary Wharf offices, you could feel the heat from all those first-class brains, working out how to make billions from financial products that only an expert in nuclear fusion could comprehend. I didn't have a clue what they were talking about. The trouble is, it turns out, neither did they.

As a former Goldman Sachs executive, Paulson understands that the unravelling of Lehman is not a sign, per se, that free markets are failing. Quite the reverse. They work best when driving out weak and inefficient operators. Creation and destruction are part of the game.

Nobody said that capitalism was devised to provide soft landings for hopeless losers. Sending a message that all sinners will be saved only encourages reckless behaviour.

Meddling politicians often find this impossible to accept. They would rather pay a stricken company's ransom than face the wrath of voters whose interests are linked to a business about to go bust.

Which explains Gordon Brown's willingness to jet-hose a relative tiddler like Northern Rock with Treasury largesse, instead of allowing the bank to take its chances in administration. The Rock's nationalisation was not about saving the banking system from oblivion. I

t was a cynical and unduly expensive exercise in electoral engineering failed to instill confidence in other UK mortgage lenders (shares in wobbly Halifax Bank of Scotland fell by more than 15 per cent yesterday).

By contrast, in America, Fannie Mae and Freddie Mac were special cases. Not because they are inextricably linked to the US housing market - although that is true ($5.4 trillion of liabilities) - but because from the outset they were "government-sponsored" private companies.

As quasi state bodies, their implicit guarantee was that Washington stood behind them. Had they gone under, it would have told the world that Uncle Sam was happy to renege on his promises.

While unbothered by the wiping out of shareholders in Fannie and Freddie, the US Treasury was determined to preserve value for their bondholders. The reason was that these bonds are held in vast quantities by foreign governments, notably China's, whose confidence Washington is desperate not to lose.

With more than $1 trillion of foreign-exchange reserves, China is equally anxious that America's economy, and with it the dollar, does not get flushed away.

As Paulson was blocking state aid to Lehman, Merrill Lynch sold itself to Bank of America in what looks like a panic-stricken dash for the lifeboats while they still exist. Founded in 1914, Merrill's corporate logo is a raging bull.

Who could have imagined that by charging about in the china shop of sub-prime mortgages, the bank's hubristic management would smash 94 years of independence? The Thundering Herd, as Merrill is known, looks more like The Blundering Nerd.

That said, the price Bank of America is paying is a hefty premium to Merrill's recent share price - and none of the money is from US Treasury coffers.

Add Lehman and Merrill to Bear Stearns, which fell into the arms of JP Morgan at a knockdown price earlier this year, and it becomes clear that investment banking has changed forever. Never again, at least not until the next time, will they be allowed such free rein.

After this mess is over - perhaps even before then - there will be a regulatory backlash. Everything from credit risk and lending ratios to salaries and share issues will come under fiercer scrutiny.

The high-water mark of US financial hegemony was passed several years ago, when both government and consumers became addicted to cheap debt to pay bills they could not afford. The problem was, too few seemed to notice.

The richest nation on earth carried on borrowing and spending until the fantasy morphed into madness: Ninja debtors - No Income, Jobs or Assets - were lent money by wannabe alchemists to buy homes at unfathomable valuations.

A couple of years ago, Steve Forbes, the former US presidential candidate and business publisher, told me he thought the American car industry was going bust. He said it was only a matter of time before Detroit's finest turned up in Washington looking for a comprehensive bail-out, costing tens if not hundreds of billions of dollars.

What's more, he predicted, they would get the money.

Had Lehman been handed a get-out-of-jail card, demands for similar treatment from other beleaguered businesses would have poured on to Paulson's desk. There are plenty of them. General Motors and Ford have made pre-emptive strikes.

Remarkable, isn't it, how those who champion the survival of the fittest are quickly converted into supporters of lame ducks when they become one. Banks that deprecated state intervention while sloshing about in easy money are calling for the creation of government agencies to "facilitate the consolidation of the financial sector".

The trouble with inviting in governments is that they don't know when to leave.

As the world's buyer of last resort, the American shopper is exhausted. Having drained all credit, he can barely keep up with mortgage payments and is scared stiff that his job is about to be axed. The world's locomotive of consumption is leaking oil.

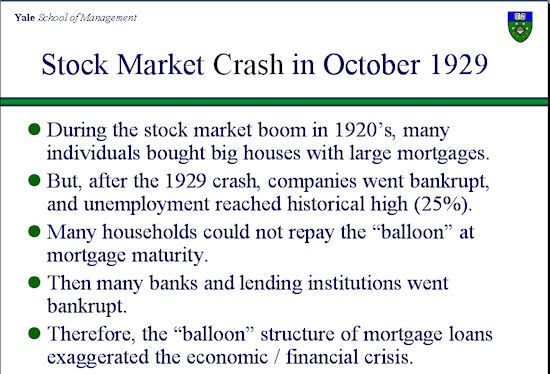

Not since the Wall Street Crash of nearly 80 years ago has the financial system that supports Joe Sixpack's lifestyle been so severely stretched. Lehman has gone, others seem sure to follow. There will be no quick fix.

http://www.telegraph.co.uk/money/main.j ... eff116.xml