Global Economy

Re: GLOBAL ECONOMY

but that helps doctors, nurses, medical eqpt suppliers and pharma cos (like lipitor maker)...in short you protect american jobs and help the local economy.

you need no doubt order a lot of pizza to go with the cold beer and again that benefits

the local pizza guy, artisanal cheese makers, the tomato and capsicum farmers and the

pizza dough maker...all stuff that is made in US of A.

*insert cheesy music and drumroll here*

you need no doubt order a lot of pizza to go with the cold beer and again that benefits

the local pizza guy, artisanal cheese makers, the tomato and capsicum farmers and the

pizza dough maker...all stuff that is made in US of A.

*insert cheesy music and drumroll here*

Big News!!

Citigroup to slash 52,000 jobs

Reuters.com wrote: Mon Nov 17, 2008 11:45am EST

* 15 percent of work force to be eliminated

* Expenses to be slashed 20 percent

* Shares decline 5 percent (Recasts first paragraph, adds details)

By Jonathan Stempel and Dan Wilchins

NEW YORK, Nov 17 (Reuters) - Citigroup Inc revealed plans to cut 52,000 jobs by early next year in a dramatic move to restore the No. 2 U.S. bank to health as it combats mounting debt losses and sagging economies worldwide.

The reductions announced on Monday by Chief Executive Vikram Pandit will affect 15 percent of Citigroup's (C.N: Quote, Profile, Research, Stock Buzz) work force, and are in addition to 23,000 jobs eliminated between January and September. They are the deepest cuts announced by any U.S. financial services company since the global credit crisis began last year.

Citigroup's cuts will be global, affecting many regions and business lines, including the retail and investment banks, a person close to the matter said. About one-half will come from layoffs and attrition, and the rest from the sale of units, such as the German retail banking business.

Pandit became Citigroup's CEO last December, and has faced much criticism from investors and others for failing to implement a workable turnaround plan. The bank has lost $20.3 billion in the last year, and some analysts do not expect it to make money before 2010.

"As the economy continues to weaken they will have greater credit losses," said Michael Holland, founder of money manager Holland & Co in New York. "Cuts will lessen the losses, but they in no way guarantee profitability."

The latest cuts would leave Citigroup with about 300,000 employees, down 20 percent from the end of 2007 and roughly the same number it had at the end of 2005.

Citigroup plans to slash expenses by 20 percent from peak levels and spend a total of $50 billion to $52 billion in 2009. That compares with $61.9 billion over the last four quarters.

Shares of Citigroup, a component of the Dow Jones industrial average .DJI, fell 28 cents, or 3 percent, to $9.24 on the New York Stock Exchange.

STOCK UNDER PRESSURE

Last week, Citigroup stock fell into the single digits for the first time since Sanford "Sandy" Weill created the bank in 1998 from the merger of Travelers Group Inc and Citicorp.

Well over 100,000 jobs have already been lost at the largest banks and brokerages. In the last month, Goldman Sachs Group Inc began cutting 3,200 jobs, while Morgan Stanley said it will cut 10 percent of the jobs in the unit housing its investment banking operations.

Citigroup said it plans to make the latest job cuts in the "near term." People at the New York bank said it expects to complete the reductions in the first couple of months of 2009.

"If the past is any guide, Wall Street overshoots in terms of hiring, and then overshoots when it's time to cut jobs," said Walter Todd, portfolio manager at Greenwood Capital Associates LLC, which invests $1 billion. "It's a moving target."

Citigroup said it has a "very strong" capital position, and according to the person close to the matter has no need to cut its dividend, which has already been reduced twice this year.

Still, many investors remained wary. Through Friday, the bank's stock was down 68 percent this year, leaving Citigroup with a market value of $51.9 billion.

That's barely twice the $25 billion of capital it received from the U.S. Treasury Department's bank bailout plan, and down from more than $270 billion in late 2006.

"We have a bull market in fear," said Henry Asher, president of Northstar Group Inc in New York.

DIVERSIFICATION DOESN'T HELP

Citigroup was built principally by Weill, who ceded control to Pandit's predecessor, Charles Prince, in 2003.

Analysts believe Citigroup never invested enough in technology or to make the bank's various parts work well together.

Its geographic diversity, including operations in more than 100 countries, is now also working against it as customers in such countries as Brazil, India and Mexico find it harder to keep up with their bills.

At the same time, Citigroup's ability to grow at home is relatively limited. Last month, Wells Fargo & Co derailed Citigroup's attempt to buy Wachovia Corp and its $418.8 billion in deposits.

The bank has been trying to downplay reports of dissension among its directors regarding the performance of Pandit and the bank's chairman, Sir Win Bischoff.

Last week, lead director Richard Parsons said the board supported management's plans for the bank.

(Editing by John Wallace/Jeffrey Benkoe)

Re: GLOBAL ECONOMY

Regarding the Doug Hornig two part article, are the Treasuries safe ultimately? To me the first task is to restore lending and then all follows it. What can they do to restore it?

And wasn't Citigroup trying to buy Wachovia and got thwarted by Wells Fargo a few weeks ago? So how were they planning to buy up Wachovia when they are facing such severe cuts so soon after that lost offer?

Also What hath Lehman Wrought!

And wasn't Citigroup trying to buy Wachovia and got thwarted by Wells Fargo a few weeks ago? So how were they planning to buy up Wachovia when they are facing such severe cuts so soon after that lost offer?

Also What hath Lehman Wrought!

Re: GLOBAL ECONOMY

Wachovia is a good buy but has large short term obligations. By getting the cash from Wells Fargo it could fund itself and stabilize.ramana wrote:

And wasn't Citigroup trying to buy Wachonvia and got thwarted by Wells Fargo a few weeks ago? So how were they planning to buy up Wahcovia when they are facing such severe cuts so soon after that lost offer?

Re: GLOBAL ECONOMY

my question was about citigroup? What were they thinking when two weeks after making their takeover offer they are reducing staff? Looks like congitive dissonance that shiv talks about.

Manwhile Global Economic snapshot

Manwhile Global Economic snapshot

Re: GLOBAL ECONOMY

Citibank has cash. It has to shed its other operations and get back to business. THey got cash injection from overseas which other Banks dont have access to. They are shedding their flab and making their operations profitable.ramana wrote:my question was about citigroup? What were they thinking when two weeks after making their takeover offer they are reducing staff? Looks like congitive dissonance that shiv talks about.

Manwhile Global Economic snapshot

They can still buy other banks even now.

-

Karkala Joishy

Re: GLOBAL ECONOMY

The Goldman CEO was earning $600,000 basic salary. That I think is reasonable. Paying bonus on top of that when the industry is begging for alms is ridiculous.Singha wrote:at that level - in the millions. its hard to feel any sympathy for such people

Re: GLOBAL ECONOMY

The Two Faces of Lehman's Fall

http://compliancex.typepad.com/complian ... ces-o.html

In the weeks before it collapsed, Lehman Brothers Holdings Inc. went to great lengths to conceal how fast it was careening toward the financial precipice.

The ailing securities firm quietly tapped the European Central Bank and the Federal Reserve as financial lifelines. On Sept. 10, one day after Lehman executives calculated the firm needed at least $3 billion in fresh capital, the firm assured investors on a conference call it needed no new capital at all. Lehman said its massive real-estate portfolio was valued properly, but Wall Street executives who have seen it say it was overvalued by more than $10 billion. As hedge-fund clients began yanking their money from Lehman, the firm assured them it was on solid financial footing.

[Richard Fuld, Jr.]

Richard Fuld, Jr.

On Sept. 11, J.P. Morgan Chase & Co. effectively ended Lehman's campaign to appear strong. In its capacity as a middleman between Lehman and its clients, J.P. Morgan knew more about Lehman's predicament than most outsiders, and it didn't like what it saw. J.P. Morgan demanded from Lehman $5 billion in additional collateral -- easy-to-sell securities to cover lending positions that J.P. Morgan's clients had with Lehman -- repeating an unmet request from a week earlier, people familiar with the situation say.

It was a knockout blow. That $5 billion collateral call, coupled with a huge outflow of money from Lehman's hedge-fund clients, so weakened the 158-year-old Wall Street firm that it sought Chapter 11 bankruptcy protection four days later.

During the credit crisis, financial firms have been squeezed between conflicting pressures: to tell the public the painful truth, but also not to ignite panic. The story of Lehman's desperate effort to survive -- pieced together from securities filings, bankruptcy-court documents and more than two dozen interviews with participants in the drama -- reveals for the first time how far Lehman went to save itself. The firm's behind-the-scenes maneuvering raises questions about whether it crossed the line into misleading clients and investors.

To an extraordinary degree, investment banks depend for their survival on trust -- from lenders and investors, from hedge funds and other big clients, and especially from other large banks that are their trading partners. Their businesses are so complex, their balance sheets so massive and opaque, that hardly anyone outside the tent can know for sure how much trouble a firm is in. When outsiders sense weakness, they are quick to bail out.

On Monday, the House Oversight and Government Reform Committee is holding hearings to examine the regulatory mistakes and financial excesses that led to Lehman's bankruptcy filing. Among those testifying will be Richard Fuld Jr., Lehman's chief executive officer.

FBI Inquiry

The Federal Bureau of Investigation has launched a preliminary inquiry into whether Lehman or its executives committed fraud by misrepresenting the firm's condition to investors. Prosecutors from the U.S. Attorney's office in New York's Eastern District are examining, among other things, whether Lehman executives misled investors by making upbeat comments to investors and research analysts on Sept. 10 -- five days before the firm filed for bankruptcy protection, according to people familiar with the investigation.

Former prosecutors say severe financial pressure can put executives at investment banks in a tough spot, given how important it is for them to maintain customer confidence.

"It's a dance all these executives do when your company is built on trust and you can't show weakness," says Peter Henning, a former lawyer at the Justice Department and the Securities and Exchange Commission, who now teaches at Wayne State University law school in Detroit. "But public statements of strength were used against" top executives at Enron Corp. by criminal prosecutors to show they were misleading investors, he notes. "You can look like you are talking out of both sides of your mouth."

Lehman's collapse was a decisive moment in the 13-month-old credit crisis. The government's decision not to bail out the firm set off a near panic among investors and lenders world-wide, forcing the U.S. to push through a historic rescue plan for the financial system.

Over the summer, Mr. Fuld came under pressure to replenish capital depleted by mounting real-estate losses. In August, as investors pushed down Lehman's stock, rumors began swirling that the firm was in trouble.

Mr. Fuld and his bankers contacted Bank of America Corp., MetLife Inc., HSBC Holdings PLC in the U.K., investors representing Dubai ruler Sheik Mohammed bin Rashid Al Maktoum, and China's main sovereign-wealth fund, China Investment Corp., people familiar with the matter say. The effort went nowhere. Spokespeople for the banks either declined to comment or weren't available.

Crunch Deepens

As the credit crunch deepened, the Fed had set up a new lending facility for investment banks. Although the central bank doesn't reveal who borrows from it, the market generally figures it out, and there's a stigma associated with it. Lehman didn't do so over the summer, because it didn't want to be seen as needing Fed money, says one person familiar with the matter.

Lehman went elsewhere, stepping up its borrowing from the European Central Bank. The borrowing, at least some of it by a Lehman operation in Frankfurt, drew no attention in the market. By the time Lehman sought bankruptcy protection, it owed between €8 billion and €9 billion. An ECB spokeswoman declined to comment.

[Richard Fuld Jr.] Associated Press

Richard Fuld Jr., Lehman Brothers chairman and chief executive

As concerns about Lehman spread through the market, its executives began hearing from clients. None of them wanted to have money tied up with Lehman if it filed for bankruptcy protection. Christian Lawless, a senior vice president in Lehman's European mortgage operation, says he fielded numerous calls from investors seeking to pull out assets. "You guys are financial professionals," he recalls telling some skittish clients. "Our balance sheet is better than ever."

In early September, GLG Partners, a large London hedge fund in which Lehman holds a stake, grew increasingly concerned. In a series of calls, Mr. Fuld and other Lehman executives assured GLG managers that Lehman would survive. But managers at the hedge fund, which had been trimming exposure to Lehman for months, decided to move more assets out of the firm anyway.

Shortly before Labor Day, Lehman's talks to raise capital from the Korea Development Bank fell through. On Sept. 9, after that news surfaced, Lehman's stock plunged 45% -- its largest daily percentage decline ever.

Demanding Collateral

Lehman still had superior ratings on its bonds. J.P. Morgan, however, was growing concerned. As Lehman's "clearing bank," J.P. Morgan acted as the financial middleman between Lehman and its clients. Steven Black, co-CEO of J.P. Morgan's investment bank, phoned Mr. Fuld just after lunch that day. He told the Lehman chief that in order to protect itself and its clients, J.P. Morgan needed $5 billion in additional collateral -- over and above the $5 billion J.P. Morgan had demanded five days earlier, which had yet to be paid.

Mr. Fuld managed to persuade Mr. Black to settle for $3 billion right away, leaving the prior $5 billion request unresolved. Mr. Black dispatched two J.P. Morgan investment bankers to discuss a capital-raising plan.

Meanwhile, Lehman executives arranged a conference call for the next day to announce earnings ahead of schedule and to disclose plans for a restructuring. That evening, discussions with outside bankers about possible capital raising ended without any formal plan. The bankers counseled Lehman against holding the call, warning there were too many open questions about the firm's finances.

That evening, top Lehman executives discussed the need to raise between $3 billion and $5 billion to shore up capital by early 2009, according to one person familiar with the meeting. Documents that discussed this need were circulated to senior executives, this person says.

Early the next morning, Sept. 10, Lehman hosted the conference call for investors. The firm announced that it expected its largest quarterly loss ever, $3.9 billion, driven largely by declines in real-estate valuations. Mr. Fuld said the firm intended to sell a majority stake in its investment-management division and would cut its dividend.

Lehman executives didn't say anything about needing to raise capital.

Ian Lowitt

Mike Mayo, a Deutsche Bank AG bank analyst, asked whether Lehman would need to raise $4 billion as part of the plan, according to a transcript of the call. Lehman's chief financial officer, Ian Lowitt, replied: "We don't feel that we need to raise that extra amount." At another point, Mr. Lowitt said: "Our capital position at the moment is strong."

Messrs. Fuld and Lowitt declined to comment. One Lehman executive says the firm determined sometime the prior night that additional capital wouldn't be needed because Lehman hoped to raise more money by selling additional assets.

By the following day, Sept. 11, the price of Lehman's credit-default swaps -- the cost to protect against losses on $10 million of its debt for five years -- had soared to $800,000 a year, from $219,000 at the end of May. Clients began calling and emailing Lehman to get their money out. Lehman scrambled to comply so as not to betray weakness.

But J.P. Morgan was worried about holding lending positions with Lehman if the firm collapsed. Jane Buyers Russo, head of J.P. Morgan's broker-dealer unit, phoned Lehman's treasurer, Paolo Tonucci. She told him Lehman would have to turn over the $5 billion in collateral that J.P. Morgan had asked for days earlier.

Fulfilling the request temporarily froze Lehman's computerized trading systems. It nearly left the firm with insufficient capital to fund its trading and other operations.

Lehman's unsecured creditors now say J.P. Morgan helped to spark a "liquidity crisis." J.P. Morgan calls that "unfounded conjecture."

Fed officials, who were watching Lehman closely, saw that lenders and clients were pulling back. They were growing more worried that Lehman wasn't going to make it.

On Friday afternoon, Sept. 12, credit-ratings firms warned they would downgrade Lehman's debt on Monday if it didn't raise fresh capital.

Inside Lehman, there was growing panic. So many customers called to withdraw money that it couldn't properly process the requests. The firm's cash-management system -- which each day is supposed to sweep up cash from offices such as London and redistribute it the next day -- couldn't handle the surge. Lehman's New York arm couldn't properly get money to London accounts, which left Lehman's main European arm, based in London, essentially broke by Monday. Some $5 billion that was supposed to get to Lehman's London operations or its counterparties didn't arrive by Monday, estimates PricewaterhouseCoopers LLP, which was hired to help sort out the mess.

Surviving the Weekend

Fed officials worked at Lehman's headquarters with its executives to determine which of its assets weren't already pledged to other lenders, and could be used as collateral for a Fed loan. Officials were hoping to help the firm survive into the weekend. Lehman borrowed roughly $30 billion from the Fed, on an overnight basis, paying it back by Saturday, according to several people familiar with the matter. A Lehman executive says the firm didn't borrow from the Fed at that time.

The New York Fed arranged emergency discussions, which began on Friday night as Lehman's board consulted with bankers at Lazard Ltd. Lehman hoped to strike a deal to sell itself to Bank of America or Barclays PLC. Nevertheless, its lawyers began late Friday night to prepare a Chapter 11 bankruptcy filing, in the event that it was needed.

The New York Fed summoned Wall Street executives to try to work out a solution to Lehman's dilemma. Neither Barclays nor Bank of America was interested in buying Lehman's commercial real-estate operations. The Fed asked executives from a group of firms, including Goldman Sachs Group Inc. and Credit Suisse, to value Lehman's massive commercial-real-estate portfolio and to consider investing several billion dollars each to buy it.

The executives grilled Mark Walsh, then Lehman's commercial real-estate chief, according to several people who were there. They wanted to know why Lehman hadn't more aggressively "marked down," or cut in value, its $32.6 billion commercial-real-estate holdings, these people say. Securities firms are required to "mark to market" their holdings, meaning to value them on their books at the level at which they could sell them right away.

Executives looking at Lehman's books were surprised by Lehman's high valuations on real-estate assets. Two Wall Street executives who reviewed Lehman real-estate documents say they believe the firm's real-estate valuations are roughly 35% higher than they should be.

Some of its European real-estate loans raised particular concern. According to a Lehman document reviewed by The Wall Street Journal, Lehman "marked" some European securities backed by real-estate loans at 97.9% of par value, or nearly 98 cents on the dollar. Lehman valued similar U.S. assets at 56 cents on the dollar. While the European market for such securities has been slightly better than the U.S. market, it has also been hammered by the credit crisis.

These valuations are important to thousands of Lehman creditors who are owed tens of billions of dollars. These creditors may hold that real estate as collateral, or hope to see it sold, perhaps to the federal government through the recently approved bailout plan.

Lehman believes its real-estate portfolio is properly valued. On the Sept. 10 conference call, Mr. Lowitt, the CFO, said the firm's recent sales of real-estate assets had been "in and around our marks."

By Sunday, Sept. 14, Fed officials believed Lehman had run out of options. Neither Barclays nor Bank of America would commit to a deal unless the government agreed to finance a transaction that would almost surely cost the taxpayers money. Treasury Secretary Henry Paulson insisted he wouldn't do such a deal, and Fed officials didn't feel they had a mandate to do one on their own. Meanwhile, insurance giant American International Group Inc. was teetering.

At a late-afternoon meeting with Lehman and its lawyers, officials from the New York Fed and elsewhere delivered a message: Lehman must file for bankruptcy.

Working with bankruptcy lawyer Harvey Miller, the firm put together its filing in about five hours. Shortly after midnight Sunday, Lehman sought Chapter 11 bankruptcy protection.

Mr. Lawless, the Lehman mortgage executive, emailed clients that night. "Words cannot express the sadness in the franchise that has been destroyed over the last few weeks, but I wanted to assure you that we will reappear in one form or another-stronger than ever."

The bankruptcy threw into disarray tens of billions of dollars of cash and securities entrusted to Lehman by hundreds of hedge funds that were customers of the firm's prime brokerage, which loans money and stock to hedge funds and processes their trades. Some of the world's best-known hedge funds, including D.E. Shaw & Co. and Och-Ziff Capital Management., have assets tied up in Lehman and its subsidiaries.

"I've seen some pretty significant and difficult situations, but nothing like this," says Tony Lomas, a PricewaterhouseCoopers partner.

That Monday, Lehman's broker-dealer arm, which had not itself sought bankruptcy protection, borrowed $45.5 billion from the Fed's special lending facility for investment banks. The central bank wanted to keep the unit going for at least a few days to try to preserve order in the markets while the operation unwound.

That same day, Barclays restarted talks with Lehman. The following day, the U.K. bank agreed to buy the bulk of Lehman's North American business, for $1.54 billion. To seal the deal, Barclays agreed to pay off the $45.5 billion loan that Lehman had gotten from the Fed, and to take from the Fed the collateral that backed the loan. The Fed didn't lose any money on the deal.

Back at Lehman, Mr. Fuld informed employees about the deal in a note. "I know that this has been very painful on all of you, both personally and financially," he said. "For this, I feel horrible."

Source: The Wall Street Journal

Re: GLOBAL ECONOMY

Vina was on the ball predicting the Lehman fallout more or less.

Re: GLOBAL ECONOMY

Gurus what exactly has been holding the JPY up???

Re: GLOBAL ECONOMY

copy and pasted from one of these links.Acharya wrote:If you had purchased $1,000 of shares in Delta Airlines one year ago, you would have $49.00 today.

If you had purchased $1,000 of shares in AIG one year ago, you would have $3.00 today.

If you had purchased $1,000 of shares in Lehman Brothers one year ago, you would have $0.00 today.

But, if you had purchased $1,000 worth of beer one year ago, ... drank all the beer, then turned in the aluminum cans for a recycling refund, you would have $114.00. Based on this information, the best current investment plan is to drink heavily & recycle.

http://www.google.com/search?hl=en&q=If ... h&aq=f&oq=

Re: GLOBAL ECONOMY

Acharya Garu>> If you dont attribute your sources, it would be construed as plagiarism ( I am not saying you do).

****

ramana garu>> while not being as eloquent and detailed I was harping for the last (six months to year) We aint seen nothing yet with regard to economic turmoil. ( no intention of taking away credit fro Guru Vina garu)

****

ramana garu>> while not being as eloquent and detailed I was harping for the last (six months to year) We aint seen nothing yet with regard to economic turmoil. ( no intention of taking away credit fro Guru Vina garu)

-

Nayak

- BRF Oldie

- Posts: 2552

- Joined: 11 Jun 2006 03:48

- Location: Vote for Savita Bhabhi as the next BRF admin.

Re: GLOBAL ECONOMY

Agreed, gold + silver + FD + insurance + cash liquid = peace of mind.SwamyG wrote:Stock markets have their own benefits. One does not have to park the money in sarkari banks. One does not have to earn an MBA degree to understand that one's pie needs to be split and diversified in such a manner that a loss of a single slice would not bring you to the streets.

And I didn't need a worthless MBA to come to the above conclusion.

-

Nayak

- BRF Oldie

- Posts: 2552

- Joined: 11 Jun 2006 03:48

- Location: Vote for Savita Bhabhi as the next BRF admin.

Re: GLOBAL ECONOMY

Jerry Yang to Step Down As Yahoo CEO

http://www.businessweek.com/the_thread/ ... _top+story

Posted by: Rob Hof on November 17

Yahoo co-founder and CEO Jerry Yang will step down as CEO as soon as a successor is found, the embattled Internet company just announced. The release (quoted in full after the jump) came shortly after the blog Boomtown broke the news.

Yahoo, whose stock price has sunk to just $10.63 a share as of today, down from $19 a share in late January when Microsoft made an unsolicited bid for the company, said it has begun a search for a new CEO both inside and outside the company. One source tells me that current Yahoo President Sue Decker is the only internal candidate.

It seems likely that the board will be inclined to look seriously outside, however, since Decker has a close association with Yang and the Yahoo board. Investors continue to be angry that Yahoo didn’t manage either an acquisition by Microsoft, which had offered up to $33 a share for the company, or a deal for Microsoft to take over Yahoo’s search operation, which trails far behind Google.

So why now, after many months of calls by investors for Yang’s head? One source tells me it wasn’t a particular event. “Jerry and the board said it makes sense to get somebody else in here,” says this person. “It was time for a change.” This person says discussions about Yang’s stepping down have been going on for “awhile.”

However, the move comes less than two weeks after Google ended a proposed search advertising deal with Yahoo. The search giant, whose ads Yahoo would have run on some of its pages, withdrew after the Justice Department threatened to file an antitrust lawsuit to block the deal. That deal would have brought a much-needed boost in sales and profits, including up to $450 million in operating cash flow annually, by Yahoo’s reckoning.

Meanwhile, despite continual rumors that Yahoo was discussing a deal to buy Time Warner’s AOL unit, those talks have gone nowhere. And despite Yang insisting last week that a Yahoo buyout would be in Microsoft’s best interest, Microsoft has continued to say it’s not interested.

That said, a new CEO may well bring Microsoft back to the table, some observers note. “It’s probably the beginning of the end for Yahoo,” says Eric Jackson, an activist investor who has since early 2007 pressured the company to make more changes. “Microsoft will probably come back with an offer.”

The news of Yang’s stepping down came as little surprise to some observers, who noted that investors clearly haven’t been impressed with his vision of Yahoo’s future. “The Google deal was probably the last straw,” says Ted West, CEO of search ad network LookSmart. “I don’t know how the board could have avoided it. The investment community has very little confidence in the company’s turnaround plan.”

Yang’s nearly 16-month tenure as CEO is seen by many observers as a failure so far, despite a number of product and organizational initiatives that were dwarfed by the drama of Microsoft’s six-month-long pursuit of Yahoo. He will return to his role as Chief Yahoo, which was his title for most of his time at the company, and remain on the company’s board. Yahoo’s stock rose 4% in after-hours trading following a 2% decline on Nov. 17 in a down market.

The executive search firm Heidrick & Struggles will conduct the search for a new CEO, along with Yahoo Chairman Roy Bostock. But it’s not clear who would be willing to come in to run Yahoo at this point, given the impatience of investors to turn the company’s fortunes around quickly.

The new CEO also will face huge challenges that make the prospect of a near-term improvement in Yahoo’s fortunes look slim. The worsening economy is already hitting online advertising, especially the display ads which are Yahoo’s chief source of revenues. What’s more, Yahoo already has announced a 10% layoff, which will come by mid-December. That layoff, the second this year, along with a steady stream of executive departures going back several years, has left the morale of remaining Yahoo employees low.

Some likely names include former AOL CEO Jonathan Miller, who is generally well-regarded for keeping the Time Warner unit from sinking entirely. He was proposed to join Yahoo’s board in August after activist investor Carl Icahn ditched his proxy fight against Yahoo in return for several board seats. But Miller decided not to after Time Warner reportedly threatened to invoke a non-compete agreement.

Kara Swisher at Boomtown also mentions some other obvious candidates, such as former eBay CEO Meg Whitman, former Yahoo COO Dan Rosensweig, and News Corp. COO Peter Chernin. She also mentions former Microsoft executive Kevin Johnson, who recently joined Juniper Networks as CEO.

One source indicated Decker remains a viable candidate. “I wouldn’t dismiss her,” says this person. She’s still well-liked by Wall Street for her ability to make effective presentations on the company. And she knows her way around a board room. Not least, she wasn’t deeply involved with the Microsoft debacle, so she may be seen as less likely to stand in the way of a deal with Microsoft, should one return.

But she also has been Yang’s chief lieutenant throughout a period in which Yahoo has been unable to inspire confidence among investors or many employees, who remain divided about her leadership. If she were chosen, investors no doubt would assume there will be little change in Yahoo’s direction—especially with Yang still on the board.

Whoever comes in, this seems certain to be a relief for Yang, whose reputation as a technology visionary was tarnished even among his many loyal followers inside the company. His firm stand against Microsoft’s hostile moves, and even more the fact that he ultimately beat it back, surprised many who saw him as a nice guy but not a fighter.

However, many people inside and outside the company, even some who preferred that Yahoo remain independent, believe he mishandled the Microsoft overtures. Yang claimed that when Microsoft pulled its offer, he had been expecting the software giant to continue negotiating. Instead, Microsoft CEO Steve Ballmer said he saw no way Yahoo was going to sell.

Now, with Yahoo’s stock more at scarcely a third of the last price Microsoft offered just last May, Yang may well be remembered for what he didn’t do rather than for what he did.

Re: GLOBAL ECONOMY

So??John Snow wrote:Acharya Garu>> If you dont attribute your sources, it would be construed as plagiarism ( I am not saying you do).

Re: GLOBAL ECONOMY

Keep at it I say. At least you have learnt how to copy and paste in full instead of the usual fractional sentencesAcharya wrote:So??

♪ In other news ♫

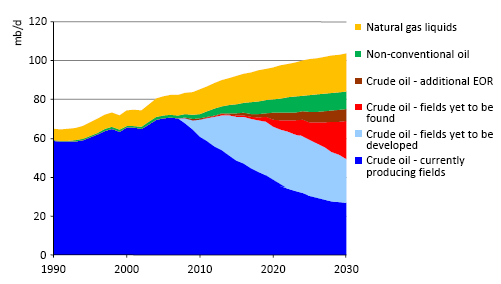

The 2008 IEA WEO - Production Decline Rates

T. Boone Pickens understands. That's why he keeps on advocating natural gas and now his wind bandwagon. Iranian natural gas reserves are critical. Around year 2008 we should have been in position to turn West Pakistan into a land locked nation (kabristan?) and lay gas pipeline in our western territory. The Iran-India pipeline. Alas, as always we'll pay heavily in future for the past non-deeds.

Last edited by Shivani on 18 Nov 2008 10:39, edited 1 time in total.

Re: GLOBAL ECONOMY

Dont worry. Chill out. It is of no concern to you. These posts are not for your curiosityShivani wrote:

Keep at it I say. At least you have learnt how to copy and paste in full instead of the usual fractional sentences. The day can't be far when the links will come included in the post and not as optional extras.

Re: GLOBAL ECONOMY

WSJ

Hewlett-Packard Co. has become the latest technology company to take short-term cost-cutting measures as the economy struggles.

The Palo Alto, Calif., tech giant notified employees last week that it would extend its normal weeklong holiday shutdown to two weeks to "achieve significant operational savings," a spokeswoman said.

Hewlett-Packard Co. has become the latest technology company to take short-term cost-cutting measures as the economy struggles.

The Palo Alto, Calif., tech giant notified employees last week that it would extend its normal weeklong holiday shutdown to two weeks to "achieve significant operational savings," a spokeswoman said.

Good commentary on US bailout situation

In Praise of a Rocky Transition

No honeymoon for you, Barack. Bush stole yours on the way out!

In addition to what the author has to say, I have my own theories why this game is being played so:The Nation wrote:

By Naomi Klein

The more details emerge, the clearer it becomes that Washington's handling of the Wall Street bailout is not merely incompetent. It is borderline criminal.

In a moment of high panic in late September, the US Treasury unilaterally pushed through a radical change in how bank mergers are taxed--a change long sought by the industry. Despite the fact that this move will deprive the government of as much as $140 billion in tax revenue, lawmakers found out only after the fact. According to the Washington Post, more than a dozen tax attorneys agree that "Treasury had no authority to issue the [tax change] notice."

Of equally dubious legality are the equity deals Treasury has negotiated with many of the country's banks. According to Congressman Barney Frank, one of the architects of the legislation that enables the deals, "Any use of these funds for any purpose other than lending--for bonuses, for severance pay, for dividends, for acquisitions of other institutions, etc.--is a violation of the act." Yet this is exactly how the funds are being used.

Then there is the nearly $2 trillion the Federal Reserve has handed out in emergency loans. Incredibly, the Fed will not reveal which corporations have received these loans or what it has accepted as collateral. Bloomberg News believes that this secrecy violates the law and has filed a federal suit demanding full disclosure.

Despite all of this potential lawlessness, the Democrats are either openly defending the administration or refusing to intervene. "There is only one president at a time," we hear from Barack Obama. That's true. But every sweetheart deal the lame-duck Bush administration makes threatens to hobble Obama's ability to make good on his promise of change. To cite just one example, that $140 billion in missing tax revenue is almost the same sum as Obama's renewable energy program. Obama owes it to the people who elected him to call this what it is: an attempt to undermine the electoral process by stealth.

Yes, there is only one president at a time, but that president needed the support of powerful Democrats, including Obama, to get the bailout passed. Now that it is clear that the Bush administration is violating the terms to which both parties agreed, the Democrats have not just the right but a grave responsibility to intervene forcefully.

I suspect that the real reason the Democrats are so far failing to act has less to do with presidential protocol than with fear: fear that the stock market, which has the temperament of an overindulged 2-year-old, will throw one of its world-shaking tantrums. Disclosing the truth about who is receiving federal loans, we are told, could cause the cranky market to bet against those banks. Question the legality of equity deals and the same thing will happen. Challenge the $140 billion tax giveaway and mergers could fall through. "None of us wants to be blamed for ruining these mergers and creating a new Great Depression," explained one unnamed Congressional aide.

More than that, the Democrats, including Obama, appear to believe that the need to soothe the market should govern all key economic decisions in the transition period. Which is why, just days after a euphoric victory for "change," the mantra abruptly shifted to "smooth transition" and "continuity."

Take Obama's pick for chief of staff. Despite the Republican braying about his partisanship, Rahm Emanuel, the House Democrat who received the most donations from the financial sector, sends an unmistakably reassuring message to Wall Street. When asked on This Week With George Stephanopoulos whether Obama would be moving quickly to increase taxes on the wealthy, as promised, Emanuel pointedly did not answer the question.

This same market-coddling logic should, we are told, guide Obama's selection of treasury secretary. Fox News's Stuart Varney explained that Larry Summers, who held the post under Clinton, and former Fed chair Paul Volcker would both "give great confidence to the market." We learned from MSNBC's Joe Scarborough that Summers is the man "the Street would like the most."

Let's be clear about why. "The Street" would cheer a Summers appointment for exactly the same reason the rest of us should fear it: because traders will assume that Summers, champion of financial deregulation under Clinton, will offer a transition from Henry Paulson so smooth we will barely know it happened. Someone like FDIC chair Sheila Bair, on the other hand, would spark fear on the Street--for all the right reasons.

One thing we know for certain is that the market will react violently to any signal that there is a new sheriff in town who will impose serious regulation, invest in people and cut off the free money for corporations. In short, the markets can be relied on to vote in precisely the opposite way that Americans have just voted. (A recent USA Today/Gallup poll found that 60 percent of Americans strongly favor "stricter regulations on financial institutions," while just 21 percent support aid to financial companies.)

There is no way to reconcile the public's vote for change with the market's foot-stomping for more of the same. Any and all moves to change course will be met with short-term market shocks. The good news is that once it is clear that the new rules will be applied across the board and with fairness, the market will stabilize and adjust. Furthermore, the timing for this turbulence has never been better. Over the past three months, we've been shocked so frequently that market stability would come as more of a surprise. That gives Obama a window to disregard the calls for a seamless transition and do the hard stuff first. Few will be able to blame him for a crisis that clearly predates him, or fault him for honoring the clearly expressed wishes of the electorate. The longer he waits, however, the more memories fade.

When transferring power from a functional, trustworthy regime, everyone favors a smooth transition. When exiting an era marked by criminality and bankrupt ideology, a little rockiness at the start would be a very good sign.

- The Detroit Meltdown of 2008. Barack Hussein and democrats need all the help from Bush and (lame) congress to make sure GM doesn't file for bankruptcy. Chrysler is living off Cerebrus' funds as it is, and Ford is keeping a low profile because the family doesn't want to attract any attention to their disproportionate voting power in FMC.

All three need cash infusion, and that area is democrat territory. Million plus jobs. Better to compromise on principles and get as much as possible from Congress and Bush. It is Bush and Congress who are mutilating the DOE package, not Barack Hussein. He is merely 'concerned' about the jobs and industry. - The inability to do much anything productive at this stage. Hussein might disagree on the handling of some issues, but he is not the president yet. If he speaks out now and that causes trouble in market (or compromise his ability to affect 'change' post oath ceremony), he'll be the villain before stepping in the office. Let Bush and Paulson CFIT the economy.

- A private agreement with key republicans. That party is at corssroads and there's dissent in the ranks. No overt criticism of Bush and republicans at this stage earns some goodwill that might come handy when reaching across the aisle later in his presidential term.

- An interview with reality for Barack? He looked to have certain plans, and perhaps now realizes that the situation at hand restricts his options. The time till inaugration is good opportunity to correct the errors in homework and come up with a program that is more in touch with ground realities.

No honeymoon for you, Barack. Bush stole yours on the way out!

Re: GLOBAL ECONOMY

http://www.marketwatch.com/news/story/w ... TNMostRead

30 'leading edge' indicators of the coming Great Depression 2

Every day there is more breaking news, proof Wall Street's greed is already back to "business as usual" and in denial, grabbing more and more from the new "Bailouts-R-Us" bonanza of free taxpayer cash and credits, like two-year-olds in a toy store at Christmas -- anything to boost earnings, profits and stock prices, and keep those bonuses and salaries flowing, anything to blow a new bubble.

Scan these 30 "leading indicators." Each problem has one or more possible solutions, but lacks unified political support. Time's running out. We're already at the edge. Add up the trillions in debt: Any collective solution will only compound our problems, because the cumulative debt will overwhelm us, make matters worse:

1.

America's credit rating may soon be downgraded below AAA

2.

Fed refusal to disclose $2 trillion loans, now the new "shadow banking system"

3.

Congress has no oversight of $700 billion, and Paulson's Wall Street Trojan Horse

4.

King Henry Paulson flip-flops on plan to buy toxic bank assets, confusing markets

5.

Goldman, Morgan lost tens of billions, but planning over $13 billion in bonuses this year

6.

AIG bails big banks out of $150 billion in credit swaps, protects shareholders before taxpayers

7.

American Express joins Goldman, Morgan as bank holding firms, looking for Fed money

8.

Treasury sneaks corporate tax credits into bailout giveaway, shifts costs to states

9.

State revenues down, taxes and debt up; hiring, spending, borrowing add even more debt

10.

State, municipal, corporate pensions lost hundreds of billions on derivative swaps

11.

Hedge funds: 610 in 1990, almost 10,000 now. Returns down 15%, liquidations up

12.

Consumer debt way up, now at $2.5 trillion; next area for credit meltdowns

13.

Fed also plans to provide billions to $3.6 trillion money-market fund industry

14.

Freddie Mac and Fannie Mae are bleeding cash, want to tap taxpayer dollars

15.

Washington manipulating data: War not $600 billion but estimates actually $3 trillion

16.

Hidden costs of $700 billion bailout are likely $5 trillion; plus $1 trillion Street write-offs

17.

Commodities down, resource exporters and currencies dropping, triggering a global meltdown

18.

Big three automakers near bankruptcy; unions, workers, retirees will suffer

19.

Corporate bond market, both junk and top-rated, slumps more than 25%

20.

Retailers bankrupt: Circuit City, Sharper Image, Mervyns; mall sales in free fall

21.

Unemployment heading toward 8% plus; more 1930's photos of soup lines

22.

Government policy is dictated by 42,000 myopic, highly paid, greedy lobbyists

23.

China's sees GDP growth drop, crates $586 billion stimulus; deflation is now global, hitting even Dubai

24.

Despite global recession, U.S. trade deficit continues, now at $650 billion

25.

The 800-pound gorillas: Social Security, Medicare with $60 trillion in unfunded liabilities

26.

Now 46 million uninsured as medical, drug costs explode

27.

New-New Deal: U.S. planning billions for infrastructure, adding to unsustainable debt

28.

Outgoing leaders handicapping new administration with huge liabilities

29.

The "antitaxes" message is a new bubble, a new version of the American

dream offering a free lunch, no sacrifices, exposing us to more false promises

Will the next meltdown, the third of the 21st Century, trigger a second Great Depression? Or will the 2007-08 crisis simply morph into a painful extension of today's mess to 2011 and beyond, with no new bull market, no economic recovery as our new president hopes?

-

Arya Sumantra

- BRFite

- Posts: 558

- Joined: 02 Aug 2008 11:47

- Location: Deep Freezer

Re: GLOBAL ECONOMY

Finally something that I have saying for long

Forget Bretton Woods II – we need a gold standard

Without the integrity and restraint a gold standard provides, America may be headed on a path to hyperinflation.

By Walker Todd

from the November 17, 2008 edition

Chagrin Falls, Ohio - Too much credit and easy money. Those were the biggest culprits behind this financial crisis. Yet, apallingly, the government's rescue attempt is built on more credit and even easier money. That's like giving a procrastinator a deadline extension. By choosing this course, Washington has steered us on to the "road to Weimar" – the road to runaway inflation.

It didn't have to come to this. And it still doesn't. But the proper remedy will take tremendous political courage: Bring back the gold standard. That, more than any byzantine regulations that emerge from the Bretton Woods II conference this weekend, would provide stability and safety for nations and individuals around the world.

Sadly, current policy seems to reflect a desire to weaken the dollar as quickly as possible.

The Federal Reserve's own data tells the story. The headline is the doubling of Federal Reserve credit, the main component of the US monetary base. Since Labor Day 2008, it's risen from $894 billion to $2.2 trillion.

That's the greatest monetary expansion in the Fed's 95-year history. How the Fed is doing it matters almost as much. It has nearly abandoned its traditional instrument for monetary policy, open-market operations, which involves the purchasing and selling of full-faith-and-credit US Treasury securities. With increasing frequency and amounts, it has relied primarily on "discount window operations" – lending to specific institutions for specific purposes instead of general injections of funds into an open market – since August 2007. This shift may weaken its ability to "tighten" monetary conditions should inflation reach dangerous levels.

A gold standard offers exactly the kind of discipline that's missing from the Fed. But its impact would be wider: Both in substance and in symbolism, gold provides integrity to the entire global financial system. Governments, however, have historically bridled at the constraint and accountability a gold standard brings. After all, when currency can be exchanged for gold, it's harder for governments to inflate the money supply, which they're tempted to do in order to spend beyond their means or cheat on their debts.

Before 1933, you could, generally speaking, trade a US dollar for a set amount of gold. That gave the dollar strength and stability. During World War I, when European governments abandoned gold and inflated their currencies to pay for the war effort, the US maintained its gold backing.

In 1933, however, to enable the Treasury to finance massive new government spending hailed as an economic recovery package – sound familiar? – President Roosevelt suspended domestic transactions in gold, and reduced the dollar's gold value. Finally, in 1971, President Nixon officially abandoned the gold standard. The dollar – and inflation – has fluctuated wildly ever since.

Today's Fed thus faces virtually no constraints. Were a gold standard in place, it could not possibly have doubled its balance sheet in only seven weeks without triggering a wholesale flight from the dollar analogous to the summer of 1971.

Weimar Germany experienced one of the greatest inflations in modern history in 1922 and 1923. Eventually, the official exchange rate reached 4.2 trillion marks per dollar. Some Germans heated their homes by burning cash, since it was cheaper than buying wood. The inflation finally was tamed by government bonds promising repayment in gold, backed by land taxes also payable in gold.

Today, if the US price level responded directly with the Fed's current rate of expansion of its own credit, then the technical conditions for Weimar-style hyperinflation could be upon us. Fortunately, Fed credit expansion acts on the domestic price level with a significant time lag. But could it tighten monetary conditions if it had to, having shifted its reliance to the discount window and the specific projects being financed there?

That's why a conversation about a gold standard is needed. But could it realistically make a comeback? Anna J. Schwartz, who co-wrote with Milton Friedman the highly influential book, "A Monetary History of the United States: 1867-1960," suggested at a 2004 gold conference at the American Institute for Economic Research that only a crisis of sufficient depth and magnitude would provoke the public to demand the stability of gold or a gold-linked currency. Such a crisis, which appeared remote at the time, may soon be upon us.

There's another significant point that Ms. Schwartz raised in 2004: The size of government itself would have to shrink radically to permit a complete return to gold. Before 1933, the share of gross domestic product represented by government at all levels was about 10 percent. Today, the national average of that share is about 35 percent. Any adjustment to economic shocks has to be absorbed by a proportionately much smaller private sector than was the case 75 years ago.

Some critics worry that a return to gold would make credit harder to come by. It's true that the kind of ultra-loose credit that fuels housing bubbles would be marginalized, but normal credit in a gold system would tend to be cheaper because concerns about the future value of repayments are diminished.

America faces a stark choice. The path back to a gold standard is rocky and uphill. The current inflationary path is slippery and downhill. One leads to integrity and stability. The other could lead to financial ruin. Which will we choose?

• Walker Todd, an economic consultant with 20 years' experience at the Federal Reserve Banks of New York and Cleveland, is a research fellow and conference organizer for the American Institute for Economic Research in Great Barrington, Mass

Forget Bretton Woods II – we need a gold standard

Without the integrity and restraint a gold standard provides, America may be headed on a path to hyperinflation.

By Walker Todd

from the November 17, 2008 edition

Chagrin Falls, Ohio - Too much credit and easy money. Those were the biggest culprits behind this financial crisis. Yet, apallingly, the government's rescue attempt is built on more credit and even easier money. That's like giving a procrastinator a deadline extension. By choosing this course, Washington has steered us on to the "road to Weimar" – the road to runaway inflation.

It didn't have to come to this. And it still doesn't. But the proper remedy will take tremendous political courage: Bring back the gold standard. That, more than any byzantine regulations that emerge from the Bretton Woods II conference this weekend, would provide stability and safety for nations and individuals around the world.

Sadly, current policy seems to reflect a desire to weaken the dollar as quickly as possible.

The Federal Reserve's own data tells the story. The headline is the doubling of Federal Reserve credit, the main component of the US monetary base. Since Labor Day 2008, it's risen from $894 billion to $2.2 trillion.

That's the greatest monetary expansion in the Fed's 95-year history. How the Fed is doing it matters almost as much. It has nearly abandoned its traditional instrument for monetary policy, open-market operations, which involves the purchasing and selling of full-faith-and-credit US Treasury securities. With increasing frequency and amounts, it has relied primarily on "discount window operations" – lending to specific institutions for specific purposes instead of general injections of funds into an open market – since August 2007. This shift may weaken its ability to "tighten" monetary conditions should inflation reach dangerous levels.

A gold standard offers exactly the kind of discipline that's missing from the Fed. But its impact would be wider: Both in substance and in symbolism, gold provides integrity to the entire global financial system. Governments, however, have historically bridled at the constraint and accountability a gold standard brings. After all, when currency can be exchanged for gold, it's harder for governments to inflate the money supply, which they're tempted to do in order to spend beyond their means or cheat on their debts.

Before 1933, you could, generally speaking, trade a US dollar for a set amount of gold. That gave the dollar strength and stability. During World War I, when European governments abandoned gold and inflated their currencies to pay for the war effort, the US maintained its gold backing.

In 1933, however, to enable the Treasury to finance massive new government spending hailed as an economic recovery package – sound familiar? – President Roosevelt suspended domestic transactions in gold, and reduced the dollar's gold value. Finally, in 1971, President Nixon officially abandoned the gold standard. The dollar – and inflation – has fluctuated wildly ever since.

Today's Fed thus faces virtually no constraints. Were a gold standard in place, it could not possibly have doubled its balance sheet in only seven weeks without triggering a wholesale flight from the dollar analogous to the summer of 1971.

Weimar Germany experienced one of the greatest inflations in modern history in 1922 and 1923. Eventually, the official exchange rate reached 4.2 trillion marks per dollar. Some Germans heated their homes by burning cash, since it was cheaper than buying wood. The inflation finally was tamed by government bonds promising repayment in gold, backed by land taxes also payable in gold.

Today, if the US price level responded directly with the Fed's current rate of expansion of its own credit, then the technical conditions for Weimar-style hyperinflation could be upon us. Fortunately, Fed credit expansion acts on the domestic price level with a significant time lag. But could it tighten monetary conditions if it had to, having shifted its reliance to the discount window and the specific projects being financed there?

That's why a conversation about a gold standard is needed. But could it realistically make a comeback? Anna J. Schwartz, who co-wrote with Milton Friedman the highly influential book, "A Monetary History of the United States: 1867-1960," suggested at a 2004 gold conference at the American Institute for Economic Research that only a crisis of sufficient depth and magnitude would provoke the public to demand the stability of gold or a gold-linked currency. Such a crisis, which appeared remote at the time, may soon be upon us.

There's another significant point that Ms. Schwartz raised in 2004: The size of government itself would have to shrink radically to permit a complete return to gold. Before 1933, the share of gross domestic product represented by government at all levels was about 10 percent. Today, the national average of that share is about 35 percent. Any adjustment to economic shocks has to be absorbed by a proportionately much smaller private sector than was the case 75 years ago.

Some critics worry that a return to gold would make credit harder to come by. It's true that the kind of ultra-loose credit that fuels housing bubbles would be marginalized, but normal credit in a gold system would tend to be cheaper because concerns about the future value of repayments are diminished.

America faces a stark choice. The path back to a gold standard is rocky and uphill. The current inflationary path is slippery and downhill. One leads to integrity and stability. The other could lead to financial ruin. Which will we choose?

• Walker Todd, an economic consultant with 20 years' experience at the Federal Reserve Banks of New York and Cleveland, is a research fellow and conference organizer for the American Institute for Economic Research in Great Barrington, Mass

-

Nayak

- BRF Oldie

- Posts: 2552

- Joined: 11 Jun 2006 03:48

- Location: Vote for Savita Bhabhi as the next BRF admin.

Re: GLOBAL ECONOMY

What’s the Value of a Big Bonus?

http://www.nytimes.com/2008/11/20/opini ... ef=opinion

Article Tools Sponsored By

By DAN ARIELY

Published: November 19, 2008

Durham, N.C.

BY withholding bonuses from their top executives, Goldman Sachs and UBS may soften negative reaction from Congress and the public if their earnings reports in December are poor, as is expected. But will they also suffer because their executives, lacking the motivation that big bonuses are thought to provide, will not do their jobs well?

Of course, there are many reasons to be disgusted with executive pay. It feels unfair that so many people make so much money managing our money, and it is often difficult to see how their talent and abilities justify their compensation. We find it particularly offensive when executives receive high bonuses after disastrous performances. But doesn’t the promise of a big bonus push people to work to the best of their ability?

To look at this question, three colleagues and I conducted an experiment. We presented 87 participants with an array of tasks that demanded attention, memory, concentration and creativity. We asked them, for instance, to fit pieces of metal puzzle into a plastic frame, to play a memory game that required them to reproduce a string of numbers and to throw tennis balls at a target. We promised them payment if they performed the tasks exceptionally well. About a third of the subjects were told they’d be given a small bonus, another third were promised a medium-level bonus, and the last third could earn a high bonus.

We did this study in India, where the cost of living is relatively low so that we could pay people amounts that were substantial to them but still within our research budget. The lowest bonus was 50 cents — equivalent to what participants could receive for a day’s work in rural India. The middle-level bonus was $5, or about two weeks’ pay, and the highest bonus was $50, five months’ pay.

What would you expect the results to be? When we posed this question to a group of business students, they said they expected performance to improve with the amount of the reward. But this was not what we found. The people offered medium bonuses performed no better, or worse, than those offered low bonuses. But what was most interesting was that the group offered the biggest bonus did worse than the other two groups across all the tasks.

We replicated these results in a study at the Massachusetts Institute of Technology, where undergraduate students were offered the chance to earn a high bonus ($600) or a lower one ($60) by performing one task that called for some cognitive skill (adding numbers) and another one that required only a mechanical skill (tapping a key as fast as possible). We found that as long as the task involved only mechanical skill, bonuses worked as would be expected: the higher the pay, the better the performance. But when we included a task that required even rudimentary cognitive skill, the outcome was the same as in the India study: the offer of a higher bonus led to poorer performance.

If our tests mimic the real world, then higher bonuses may not only cost employers more but also discourage executives from working to the best of their ability.

We later did a variation of the same experiment, at the University of Chicago, to look at a different kind of motivator: public scrutiny. We asked 39 participants to solve anagram puzzles, sometimes privately in a cubicle and sometimes in front of the others. We reasoned that their motivation to do well would be higher in public, and we wanted to see if this would affect their performance. But we found that while the subjects wanted to perform better when they worked in front of others, in fact they did worse.

So it turns out that social pressure has the same effect that money has. It motivates people, especially when the tasks at hand require only effort and no skill. But it can provide stress, too, and at some point that stress overwhelms the motivating influence.

When I recently presented these results to a group of banking executives, they assured me that their own work and that of their employees would not follow this pattern. (I pointed out that with the right research budget, and their participation, we could examine this assertion. They weren’t that interested.) But I suspect that they were too quick to discount our results. For most bankers, a multimillion-dollar compensation package could easily be counterproductive. Maybe that will be some comfort to the boards at UBS and Goldman Sachs.

Dan Ariely, a professor of behavioral economics at Duke, is the author of “Predictably Irrational: The Hidden Forces That Shape Our Decisions.”

-

Nayak

- BRF Oldie

- Posts: 2552

- Joined: 11 Jun 2006 03:48

- Location: Vote for Savita Bhabhi as the next BRF admin.

Re: GLOBAL ECONOMY

Toyota, BMW, Hyundai Workers' Senators Oppose Rescue of Big - 3. The CEO's of big 3 flew in private jets to beg for US Taxpayer's money. Bailout refused as Dubya wants to leave the ugly decision to Obama.

Looks like time will be ripe soon for Tata/Mahindra to pick up good solid assets from these obese companies.

Even Jack Welch is against the bailout. I hope these 3 die a slow and painful death.....

Looks like time will be ripe soon for Tata/Mahindra to pick up good solid assets from these obese companies.

Even Jack Welch is against the bailout. I hope these 3 die a slow and painful death.....

Re: GLOBAL ECONOMY

Tata wasted its money acquiring Jaguar and Land rover at inflated prices.,

Mahindra & Mahindra must be breathing a sigh of relief that they lost the bid.

Mahindra & Mahindra must be breathing a sigh of relief that they lost the bid.

Re: GLOBAL ECONOMY

The state in the Gulf from veteran Dawn journo Irfan Hussein.

http://www.dawn.com/weekly/mazdak/mazdak.htm

Pleasure and pain, loss and gain

By Irfan Husain

As I grow older, I find that some books I read years ago have largely faded from memory. Characters and plots blur and only a few memorable phrases remain. For example, I recall struggling through William Burroughs’ chaotic The Naked Lunch in the Seventies, and now have only a hazy recollection of William Lee, the spaced out protagonist. And while I would not swear to it in a court of law, I think he said, in effect, that he would like to be around when the Arabs ran out of oil. I remember agreeing with him then, as I do now.

In those days, the oil boycott had caused the price of oil to shoot up, making several Arab royal families very rich indeed. The Western media was full of stories about sheikhs and sheikhlets losing millions at the gaming tables of Monaco and Las Vegas; of entire hotel floors booked for travelling Arab millionaires; and diamond encrusted watches being presented to cigar girls at nightclubs. Shopping sprees at Harrods’ in London would see hundreds of thousands of pounds being spent on garish clothes and chintzy furniture the owners of the store stocked for their Middle Eastern clients.

While this spending spree went on, the world laughed enviously, while fleecing the Arabs by selling them billions of dollars of arms that would never be used. And although the worst of these excesses abated (or perhaps we just got used to them), the oil-rich Gulf became a byword for opulence and tasteless spending. The recent construction boom in Dubai has done little to change this perception with an indoor ski lift in 45-degree heat; palm-shaped islands reclaimed from the sea; and garish, gigantic shopping malls. The recent spike in oil prices went hand in hand with a vast construction bubble that saw thousands of apartments being built at feverish pace. Underpinning this frantic building spurt is a vast army of underpaid, exploited workers from Pakistan, India and other developing countries. From time to time, they have agitated against rapacious builders who keep them in sub-human conditions, only to be ruthlessly put down by the local police. When the banking crisis hit Western economies, it was assumed that given their oil wealth, the Gulf states would escape the global recession. One Iranian ayatollah even exulted in the American predicament, saying that this was a sign of the wrath of God, directed at the West. I doubt if he’s still singing the same tune, now that oil is down to around $50 a barrel, as against the highs of $145 a few months ago.

The fact is that the world economy is now too closely integrated for any country to escape the downturn. Although the UAE’s official spokesmen and the controlled media are sending out the message that all is well, the truth is that the financial storm battering the rest of the world has not spared the Gulf states. This is an entry posted on an expat blog by somebody calling himself Easy Rider:

“Even in Dubai, it’s not pretty. The real estate market is crashing. People are starting to get fired. Banks are slowly beginning to stop lending. The stock market is in dire straits… I think Dubai will be affected by the crisis just the same as the rest of the world, maybe even worse. A bursting bubble hurts.”

Although several oil-rich states have built up vast sovereign funds to tide them over crises, their value has been severely eroded by the collapse of stock markets and the value of real estate, the primary areas most funds have invested in. Another problem with rich Gulf states is that all oil revenues flow into an account that belongs to their respective royal families which allocate funds to the hundreds of sons, nephews, uncles and aunts before any money reaches the public. Thus, Saudi Arabia, the richest of the lot by far, had foreign exchange reserves amounting to a relatively paltry $30 billion a couple of months ago, while China holds reserves worth $2 trillion.

So while rapidly declining oil prices have been good news for the rest of us, oil exporters are feeling the pain. Somehow, the heart does not bleed for them. Call it schadenfreude if you like, but the sight of nouveau riche characters, who struck it rich without doing a stroke of work in their lives, having to struggle makes me feel that there is some justice in the world, after all. Now that they have created the tallest building in the world in Dubai, I look forward to some greedy developers jumping off the top, saying to each other as they hurtle down: “So far, so good.”

A friend who has an office in Dubai and spends a lot of time there thinks that all the banks there are now technically bankrupt. According to him, they have lent massive amounts to entrepreneurs who have built thousands of apartments and offices, most of which are vacant, thus providing no income to their owners. These people cannot service their loans, and are beyond normal banking laws. But as many local banks are being propped up by their well-connected sponsors, they are making a brave front of it.

Russia is another country that is facing meltdown after years of swaggering around on the basis of its huge oil and gas reserves. After bullying and browbeating its neighbours, it has suddenly come down to earth. Indeed, the collapse of the USSR was probably a blessing in disguise for Russia: the oil and gas it sold to its East European satellites at heavily subsidised rates are now being sold at international rates, cash on the barrel. This changed scenario has given the Russians greater financial clout than the creaking Soviet empire ever had.

Other losers from the oil price slump are the governments of importing countries. As many experts have pointed out, national exchequers make more money from imports than exporters. In the UK, for instance, petrol was selling at around a pound a litre at pumps last month, and the government was skimming off half this amount, leaving 50 pence for profits, transport, distribution, etc. Again, the heart does not bleed for Gordon Brown and the Treasury.

PS:Not too long ago,I read a theory put forward by an eminent psychic ,that countries with the tallest buildings suffered strangely massive economic shocks.He gave several examples ,where countries that vied with each other to build the world's tallest skyscrapers suffered immense bad luck.Irfan Hussein's article on the fall of the oil empires and Dubai,brings to mind the current fact that the world's tallest building is now in Dubai,the Burj tower,which is still climbing further and its designer says that even he doesn't know when it will stop! The tower built like a collection of tubes,the technique invented by world renowned structural engineer Fazlur Khan in Chicago for the Sears Tower.In a recent article on the Dubai tower,the designers have discovered that the higher one goes,the lighter are the loads! So the Burj keeps on climbing while the world economy and that of Dubai's "Arabian Nights" style mega-projects for the nouveau-riche billionaire and multi-millionaire class heads in the opposite direction! Perhaps the architects and latter day sheikhs and business empires should've remembered the fate of another earlier tower in the same region,not too far away too,called the "Tower of Babel".

http://www.dawn.com/weekly/mazdak/mazdak.htm

Pleasure and pain, loss and gain

By Irfan Husain

As I grow older, I find that some books I read years ago have largely faded from memory. Characters and plots blur and only a few memorable phrases remain. For example, I recall struggling through William Burroughs’ chaotic The Naked Lunch in the Seventies, and now have only a hazy recollection of William Lee, the spaced out protagonist. And while I would not swear to it in a court of law, I think he said, in effect, that he would like to be around when the Arabs ran out of oil. I remember agreeing with him then, as I do now.

In those days, the oil boycott had caused the price of oil to shoot up, making several Arab royal families very rich indeed. The Western media was full of stories about sheikhs and sheikhlets losing millions at the gaming tables of Monaco and Las Vegas; of entire hotel floors booked for travelling Arab millionaires; and diamond encrusted watches being presented to cigar girls at nightclubs. Shopping sprees at Harrods’ in London would see hundreds of thousands of pounds being spent on garish clothes and chintzy furniture the owners of the store stocked for their Middle Eastern clients.

While this spending spree went on, the world laughed enviously, while fleecing the Arabs by selling them billions of dollars of arms that would never be used. And although the worst of these excesses abated (or perhaps we just got used to them), the oil-rich Gulf became a byword for opulence and tasteless spending. The recent construction boom in Dubai has done little to change this perception with an indoor ski lift in 45-degree heat; palm-shaped islands reclaimed from the sea; and garish, gigantic shopping malls. The recent spike in oil prices went hand in hand with a vast construction bubble that saw thousands of apartments being built at feverish pace. Underpinning this frantic building spurt is a vast army of underpaid, exploited workers from Pakistan, India and other developing countries. From time to time, they have agitated against rapacious builders who keep them in sub-human conditions, only to be ruthlessly put down by the local police. When the banking crisis hit Western economies, it was assumed that given their oil wealth, the Gulf states would escape the global recession. One Iranian ayatollah even exulted in the American predicament, saying that this was a sign of the wrath of God, directed at the West. I doubt if he’s still singing the same tune, now that oil is down to around $50 a barrel, as against the highs of $145 a few months ago.

The fact is that the world economy is now too closely integrated for any country to escape the downturn. Although the UAE’s official spokesmen and the controlled media are sending out the message that all is well, the truth is that the financial storm battering the rest of the world has not spared the Gulf states. This is an entry posted on an expat blog by somebody calling himself Easy Rider:

“Even in Dubai, it’s not pretty. The real estate market is crashing. People are starting to get fired. Banks are slowly beginning to stop lending. The stock market is in dire straits… I think Dubai will be affected by the crisis just the same as the rest of the world, maybe even worse. A bursting bubble hurts.”

Although several oil-rich states have built up vast sovereign funds to tide them over crises, their value has been severely eroded by the collapse of stock markets and the value of real estate, the primary areas most funds have invested in. Another problem with rich Gulf states is that all oil revenues flow into an account that belongs to their respective royal families which allocate funds to the hundreds of sons, nephews, uncles and aunts before any money reaches the public. Thus, Saudi Arabia, the richest of the lot by far, had foreign exchange reserves amounting to a relatively paltry $30 billion a couple of months ago, while China holds reserves worth $2 trillion.

So while rapidly declining oil prices have been good news for the rest of us, oil exporters are feeling the pain. Somehow, the heart does not bleed for them. Call it schadenfreude if you like, but the sight of nouveau riche characters, who struck it rich without doing a stroke of work in their lives, having to struggle makes me feel that there is some justice in the world, after all. Now that they have created the tallest building in the world in Dubai, I look forward to some greedy developers jumping off the top, saying to each other as they hurtle down: “So far, so good.”

A friend who has an office in Dubai and spends a lot of time there thinks that all the banks there are now technically bankrupt. According to him, they have lent massive amounts to entrepreneurs who have built thousands of apartments and offices, most of which are vacant, thus providing no income to their owners. These people cannot service their loans, and are beyond normal banking laws. But as many local banks are being propped up by their well-connected sponsors, they are making a brave front of it.

Russia is another country that is facing meltdown after years of swaggering around on the basis of its huge oil and gas reserves. After bullying and browbeating its neighbours, it has suddenly come down to earth. Indeed, the collapse of the USSR was probably a blessing in disguise for Russia: the oil and gas it sold to its East European satellites at heavily subsidised rates are now being sold at international rates, cash on the barrel. This changed scenario has given the Russians greater financial clout than the creaking Soviet empire ever had.

Other losers from the oil price slump are the governments of importing countries. As many experts have pointed out, national exchequers make more money from imports than exporters. In the UK, for instance, petrol was selling at around a pound a litre at pumps last month, and the government was skimming off half this amount, leaving 50 pence for profits, transport, distribution, etc. Again, the heart does not bleed for Gordon Brown and the Treasury.