How the Treasury Bubble Will Burst and Why

WINTER INTENSIFIES

The deflationary credit contraction, or as some call a Kondratieff Winter, is intensifying. For the time being the worldwide financial and monetary systems have taken a step back from complete oblivion. The usual measurements such as the TED spread, three-month LIBOR and the two year swap spread have shown improvement. This improvement should not be mistaken for a miraculous healing because the fiat currency fractional reserve banking system is terminal. Eventually it will be replaced by a commodity currency with 100% reserves and no counter-party risk.

The system does not so much collapse as evaporate and these measurements only show a decline in the rate of the evaporation. For the most part the financial crisis of 2008 only affected Wall Street. 2009 will be the beginning of Main Street being affected. With unemployment at 17.5%, according to John Williams of ShadowStats, the Greater Depression has arrived and only begun.

A few weeks ago I explained why U.S. Treasuries are the Biggest Bubble of All. In summary, gold is the ‘risk-free asset’ and the normal and natural way for money and currency to function is with gold and silver or some other physical commodity. This allows for useful and accurate value calculation instead of the current derivative illusion. Financial historians may very well view the 95 year FRN$ bubble as an unusual anomaly and wonder how so many people were so ignorant, much like we view the culture who thought the earth was flat or that the sun revolved around the earth.

Currently as evidenced in the M1 Money Multiplier the velocity of the FRN$ is slowing tremendously. As Ludwig von Mises predicted decades ago in chapter 20 of Human Action, ‘The boom can last only as long as the credit expansion progresses at an ever-accelerated pace. … But then finally the masses wake up. … A breakdown occurs. The crack-up boom appears.’ Which begs the question:

HOW AND WHY THE U.S. TREASURY BUBBLE WILL BURST

As long as the U.S. can pay and issue debt, the currency event of hyperinflation cannot happen. Because the U.S. has no internal savings, the debt must be absorbed by foreigners. When foreign demand for U.S. debt subsides then at least two scenarios can happen: (1) printing the money with hyperinflation or (2) a default which may not result in hyperinflation. But what I want to do is focus on the liquidity pyramid.

Seeking safety and liquidity capital has moved from derivatives to real estate to commodities to MUNI bonds to listed stocks to Treasury bills to gold and all the assets either financial or tangible in between. The liquidity pyramid is not set in stone but mainly a large scale roadmap. Most assets can easily be placed in the liquidity pyramid somewhere.

At all times and in all circumstances gold remains money. Therefore, the Ancient Metal of Kings belongs at the very tip of the pyramid. Gold has been and is in tight supply because holders of capital do not want counter-party or custodial risk. Finding a trusted third party, like GoldMoney, to hold one’s bullion in a proper way is extremely hard. As a result, spreads on both coins and bars have risen significantly. People want physical possession of the ’sweat of the sun’ and not ‘paper gold’ like the problematic GLD or SLV ETFs.

COUNTER-PARTY AND CUSTODIAL RISK

An essential element of counter-party risk is the reliance on the financial ability of the counter-party. For example, if your house burns down then receiving proceeds to rebuild the house is contingent upon the insurance company’s financial ability to pay. By contrast, if you drop off a suit at the dry cleaners and they go bankrupt then you get your suit back and do not get in line with the other creditors because the suit was held in bailment.

As counter-party risk increases, holders of capital develop more suspicion of their brokers, custodian banks and on through the food chain. As holders of capital seek safety and liquidity they decrease the layers of risk between them and their purchasing power.

WHY TREASURY BILLS WILL BURST

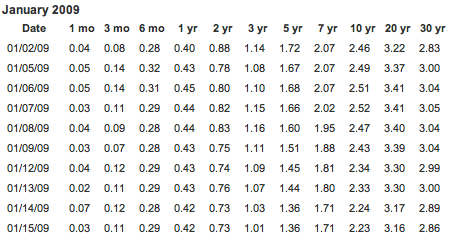

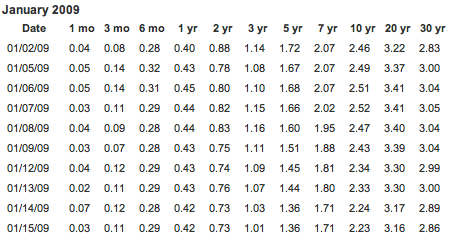

People run to Treasury Bills seeking safety and liquidity because they are lower in the liquidity pyramid. However, as more capital piles into them it drives rates lower and lower. Eventually Treasury Bill rates reach 0% or even go negative. This presents a problem.

Why hold a Treasury Bill with a bank, broker, custodian bank or the Federal Reserve itself when you could take possession of physical Federal Reserve Notes?

Taking possession eliminates at least two types of risks. First, is any potential counter-party risk with whoever is holding the Treasury Bill for you. Second, ‘political risk’ which is a much larger threat. For example, what if the Treasury Bills cannot be rolled over? What if the government does not redeem the Treasury Bills? What if the government, like other governments have done, decides to transmute the Treasury Bills into 1-2% perpetual bonds?

HOW TREASURY BILLS WILL BURST

As the yields on Treasury Bills approach 0% they have the return of cash but do not have the benefits of cash as they may be impregnated with counter-party risk or have decreased liquidity. In other words, Treasury Bills and cash have the same benefit profile but not the same safety and liquidity profile. This analysis also applies to demand deposits with the bank such as checking accounts or CDs. All the downside but none of the upside.

Holders of capital seek to eliminate their downside while maintaining the same upside resulting in less demand for government debt. To entice capital up the liquidity pyramid, rates must rise but cannot because so much capital is moving down the pyramid. To date, enticements up the pyramid have failed as MBS, Auction Rates Securities, ABCP, the DOW, S&P 500, etc. all show as asset price deflation continues and intensifies.

When a house of cards collapses there are at least cards left on the table. In the current case, there are no cards left on the table. As we see, the current system is not collapsing but evaporating.

CONCLUSION

The deflationary credit contraction is intensifying. Holders of capital seeking safety and liquidity have driven down yields on Treasury Bills. Treasury Bills have the same upside as physical Federal Reserve Notes but additional downside. As holders of capital seek to eliminate the downside for which they are not being adequately compensated demand for government debt will decline. For these reasons the U.S. Treasury Bubble is destined to burst.