Perspectives on the global economic meltdown (Jan 26 2010)

Re: Perspectives on the global economic meltdown (Jan 26 201

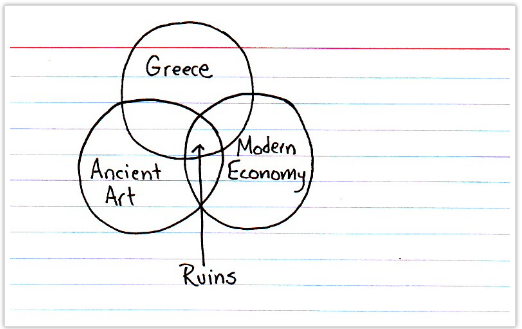

IMO, Greece ---> Portugal ---> Spain ---> Italy. At least One of these will default. I think it will be Portugal. Its an economy which is ...well it doesnt do much... Its just like Greece. I'd put my money out of Europe in a safe bank. The crisis isn't going to be pretty. France and Germany are facing most of the risk as a fall out of one of these countries failing.

-

Chinmayanand

- BRF Oldie

- Posts: 2585

- Joined: 05 Oct 2008 16:01

- Location: Mansarovar

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

my guess would be portugal might be allowed to fail like lehman. small enough not to matter and to drive the fear of god into the rest of the pig-pack.

Spain like Pakistan is "too big" to be allowed to fail. its lenders will be coughing blood looking at size of "owed"

Spain like Pakistan is "too big" to be allowed to fail. its lenders will be coughing blood looking at size of "owed"

Re: Perspectives on the global economic meltdown (Jan 26 201

how many of those are census workers ?290,000 jobs

Re: Perspectives on the global economic meltdown (Jan 26 201

typically, during a recession, savings rate falls.

The recession as per data is supposed to have ended on March 31st. The personal savings was higher than what it is now last year.

Did I bad mouth Reagan before for you to clamp such a note ? Apart from my personal liking, I indulge in partisan politics only when others indulge in them

? Apart from my personal liking, I indulge in partisan politics only when others indulge in them  ; else both the parties are the same for me. Dharma has both liberalism and conservatism within it, so I say.

; else both the parties are the same for me. Dharma has both liberalism and conservatism within it, so I say.

You know 'The Boy who cried Wolf' right? Just because the boy raised false alarms did not mean there was no wolf at the end; they are mutually exclusive events. Similarly just because there were misreadings or alarms earlier does not mean any new calls have to be misreadings or false alarms as well. The global dynamics have changed, we live in a smaller World where information flows faster than ever before. It is possible that 2000 years ago, few of our ancestors would have been sitting under the trees and crying doom and gloom on the state of the World. The nature of planet and living conditions have changed a lot since then to warrant a look at what we are doing to ourselves and the sustaining planet. 6.2 billion (give or take a few million) of people on this planet is no joke. Unless we all turn into someone similar to the Indian Yogi go goes by without food and water; we are a planet of hungry and thirsty people.

The giant strides in food production and distribution & tremendous achievements and discoveries in medicine alone have made this planet bursting with people. Many more great discoveries are possible, we do not know of them yet. But the manufacturing base in USA has been reducing since the 70s. A country needs to have a balance of agriculture, manufacturing and service industries from a stability/security point of view. One can not just look at the economics. Its population is already aging, it needs more immigration who can work and provide for others. It is not going to be easy.

The recession as per data is supposed to have ended on March 31st. The personal savings was higher than what it is now last year.

There are several discussions that address this issue. Here is one such Hegemony or Empire? The scholars can sit and argue till end of Kaliyugam for all I care on the nuances or differences. The last time USA State declared war was in the 50s - Korean War. All other were just Military Engagements. The point is USA is a powerful and influential entity in the 21st century. Power and Influence wax and wane.US is not an empire. it's a hegemony.

Did I bad mouth Reagan before for you to clamp such a note

You know 'The Boy who cried Wolf' right? Just because the boy raised false alarms did not mean there was no wolf at the end; they are mutually exclusive events. Similarly just because there were misreadings or alarms earlier does not mean any new calls have to be misreadings or false alarms as well. The global dynamics have changed, we live in a smaller World where information flows faster than ever before. It is possible that 2000 years ago, few of our ancestors would have been sitting under the trees and crying doom and gloom on the state of the World. The nature of planet and living conditions have changed a lot since then to warrant a look at what we are doing to ourselves and the sustaining planet. 6.2 billion (give or take a few million) of people on this planet is no joke. Unless we all turn into someone similar to the Indian Yogi go goes by without food and water; we are a planet of hungry and thirsty people.

The giant strides in food production and distribution & tremendous achievements and discoveries in medicine alone have made this planet bursting with people. Many more great discoveries are possible, we do not know of them yet. But the manufacturing base in USA has been reducing since the 70s. A country needs to have a balance of agriculture, manufacturing and service industries from a stability/security point of view. One can not just look at the economics. Its population is already aging, it needs more immigration who can work and provide for others. It is not going to be easy.

Re: Perspectives on the global economic meltdown (Jan 26 201

I think about 66,000 workers.Neshant wrote:how many of those are census workers ?290,000 jobs

Re: Perspectives on the global economic meltdown (Jan 26 201

there is one more bad news associated which inspite of job creation, the unemployed has increased.prad wrote:Dow closes down 140 points.

anyway, some good news in US.

290,000 jobs created in April.

i guess the sovereign debt fears are overriding any optimism that shows in the jobs numbers.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

T N Ninan: And Pigs do fly

Sri Ninan does the thankless but necessary job of keeping up the pressure on the fraudulentraping rating agencies in the court of informed desi public opinion. Hammer these frauds hard, rinse and repeat. Only.

Jai ho.

Sri Ninan does the thankless but necessary job of keeping up the pressure on the fraudulent

Excellent. trust is a hard quantity to measure but it sure counts for a lot. Its important that the halo and credibility of these faud agencies is exposed, and repeatedly+ruthlessly so,among desi public opinion. The raping agencies will find it much harder to buy back trust/cred whatever. I for sure know of hardly anyone in desi economic circles who doesn't outright laugh at rating agency cred.But Spain, which has the best rating of the four, has a 19 per cent unemployment rate (the highest in Europe), and an 11.5 per cent fiscal deficit, while its economy shrank 4.9 per cent in 2009. The others have similar profiles: high unemployment, shrinking output, large budget deficit, big public debt overhang. For good measure, they also seem to have limited wiggle room.

Yet all of them have a better sovereign rating than India, which at BBB- just about makes it to investment grade. To be sure, India’s fiscal deficit and public debt are high, but an economy growing at 8 per cent can cope with these infinitely better than one that is shrinking. Unlike the Pigs, India’s current account deficit is more than matched by capital inflows, and foreign exchange reserves are more than foreign debt, while total government debt at 82 per cent of GDP is lower than two of the four Pigs countries (Italy and Greece are at 115 per cent of GDP), and the same as for Portugal. Yet S&P thinks that India deserves a lower rating than the Pigs.

Turns out cheen is affected too. As are the other brics. A chance for us brics to get together and form a rating agency of our own, eh? Why not? We buy hajaar bonds abroad. Should not our agencies also weight in on what real interest rates ought to be expected from them?China, meanwhile, is still only at A+, although its vital statistics are better than the average for all AAA economies, be it economic growth, current account surplus, fiscal deficit, or the debt-GDP ratio. Not just China, the Bric countries on average have a lower debt-GDP ratio than many advanced economies, and lower fiscal deficits too. But does any of this reflect in the ratings? Not a chance.

What doesn't kill you makes you stronger.Rate swings of a few score basis points this way or that Yindia can handle coz it has, all this time, the hard way. Try the same experiment on the dandies in the G8 - a UKstan or France or Italy and then see the results.Ratings are important because they influence the cost of the international capital that a country accesses. Typically, a BBB country has to pay about 1 percentage point more interest than a AAA country for five-year money. The gap shrinks dramatically if you are A and not BBB, but three of the Bric economies are BBB. If the ratings were accurate, the risk premium on insuring against default would be higher for countries with lower ratings. But China commands a much lower premium than any of the Pigs — which gives the lie to the ratings. Indeed, some Indian banks access money abroad at rates that they should not be getting, since India is BBB-. Perhaps India should be A.

Jai ho.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

From TAE twitter

http://twitter.com/AutomaticEarth

Other news from the khanate:

UK-stani samachar

Asia news

http://twitter.com/AutomaticEarth

BLS cred has taken a beating. All official stats are (rightly perhaps?) looked upon with some suspicion. aajkal, bhalaai ka zamana nahi raha.LOL, BLS reports 290k job gains for April, 188k were from 'birth/death' additions, 66k were temp. census workers. Leaves real figure at 36k

So U3 unemployment at 9.9% and U6 at 17.1%, will have to check shadowstats later. You can read PDF BLS report here http://bit.ly/XUtpL

Other news from the khanate:

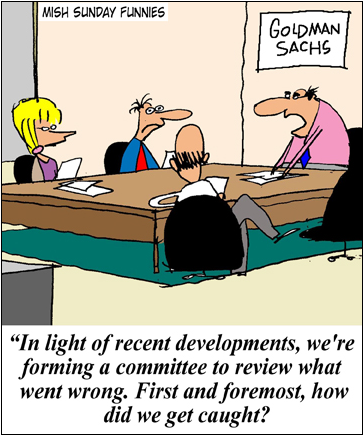

Oiro news:If people doubted it, yesterday it was confirmed with the failure of the weak bank reform bill in the senate. The banks run the show. #sad

Roubini Urges Goldman Sachs Breakup, Possible CDO Ban: Books http://bit.ly/d3mC35 (How do you break them up when they own Congress?)

Jim Rogers, Marc Faber Advise Paring Investments as U.S. Stocks Slump http://bit.ly/doWmgs

Reuters reporting Dow,S&P post largest weekly percent declines since Mar 2009;Nasdaq since Nov 2008 (I feel like i'm in the wayback machine)

wow. so CDS swaps have outdone their 2008 heights. Thats saying something.European Bank Risk Soars to Record, Default Swaps Overtake Lehman Crisis (!!!) http://bit.ly/9AcluB financials in a bad, bad place

yawnEU debt woes will result in debt defaults, says Prof Ken Rogoff (Author of 8 centuries of financial folly) http://bit.ly/aNzGLO

Australia’s central bank warned that an escalation of Europe’s debt woes may cause a “sharp” global economic slowdown http://bit.ly/9o7P82

UK-stani samachar

Well, like vina says in the indo-uk dhaga, "hallelujah".U.K. Default Swaps Jump After Electorate ‘Votes for Downgrade’ http://bit.ly/caYeTP (UK debt rating downgrade now likely)

Asia news

Asian corporate Bond Risk Climbs Most in 13 Months on European Crisis http://bit.ly/dm7fMv (Australia hard hit as well)

Just $2.5bn of global investment grade corporate debt brought to market over past 5 days, slowest week for issuance since May 1990! -Reuters

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Bloomberg reports a statement of seminal, game-changing importance....

Sri Denninger is on a roll. Again. The man is scathing if nothing. Hajaar opionated, righteous, indignant, quick-to-anger and incisive. Hugely entertaining too. Ensoi the chargesheet laid out with ruthless elan.

How To Fix The Euro Problem

To which Sri Denninger responds:“We will defend the euro, whatever it takes,” European Commission President Jose Barroso told reporters early today after the leaders met in Brussels.

ROFL onlee.The solution is simple. I offer up the following three point plan:

1.

Stop lying

2.

Stop lying

3.

Stop lying

That's it.

Sri Denninger is on a roll. Again. The man is scathing if nothing. Hajaar opionated, righteous, indignant, quick-to-anger and incisive. Hugely entertaining too. Ensoi the chargesheet laid out with ruthless elan.

How To Fix The Euro Problem

Wah wah. clap clap. I detect a whiff of Rahul Mehta-esque idealism in Sri Denninger's diatribes. Can't say I disagree with him, just that I doubt his ideas are realistic enough to survive serious consideration. Onlee.You have banks that are reportedly still carrying Iceland paper at "par", or 100 cents on the dollar, even though it defaulted.

You have banks that make ours look like Girl Scouts in terms of balance sheet opacity and truthfulness.

You have sovereigns that lied about their fiscal condition, and yet both they and the banks that did it along with them have seen little or no real penalty, and in fact you have tried to bail one of them out (Greece.)

Confidence comes from truth.

Confidence is destroyed by lies.

You, like our so-called "officials", have been lying like crazy for years.

The market is tired of it and called your bluff.

Now you get to choose - either you stop the lying, or market participants will continue to seek ways to force the lying to stop.

Ultimately the market will win if you do not stop lying.

It always does.

And to those who think that Bernanke, Geithner and Obama "got away with it" when they changed the accounting rules here in the US to make legal balance sheet fraud, I point you toward Greece, which thought it got away with it too - for several years.

The Greeks were wrong.

The ECB is wrong.

And our administration is also wrong.

There is only one solution that will work: The Truth.

Yes, it will hurt.

Yes, those who are insolvent will be recognized as insolvent, and go out of business.

Yes, economic pain will have to be taken.

The choice is between pain now and lots more soon, much sooner than you think with these "can-kicking" measures (remember, just one year ago you thought you stabilized the entire system and now we have nations at risk of failure, not just banks!)

The time has come to face reality gentlemen, before it forces recognition upon you - both here and abroad.

Re: Perspectives on the global economic meltdown (Jan 26 201

Of the remaining 200K jobs, what is the break down?SwamyG wrote: I think about 66,000 workers.

Are these all govt created jobs ?

What industry is hiring and are these skilled or unskilled professions?

I have a feeling this is just as bogus as the fake inflation numbers published by the US govt.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Errrrr, I posted this just above your query:Neshant wrote:Of the remaining 200K jobs, what is the break down?SwamyG wrote: I think about 66,000 workers.

Are these all govt created jobs ?

What industry is hiring and are these skilled or unskilled professions?

I have a feeling this is just as bogus as the fake inflation numbers published by the US govt.

Hope that helps. The 'Birth-death' model is a farce now, IMHO.BLS reports 290k job gains for April, 188k were from 'birth/death' additions, 66k were temp. census workers. Leaves real figure at 36k

Re: Perspectives on the global economic meltdown (Jan 26 201

That is because more number of people are counting themselves in rather than out, for the job hunting. Unemployment is when people want work and they don't get one. If they don't want work, then they are not counted in the pool. When people start finding work, their neighbors and friends get to know that and if they were not searching for work, then they think the conditions are better now so they start hunting for jobs too. So the unemployment rate increases initially. As long as more jobs are being added it is a positive sign. The unemployment rate is just a statistic number.Muppalla wrote:there is one more bad news associated which inspite of job creation, the unemployed has increased.prad wrote:Dow closes down 140 points.

anyway, some good news in US.

290,000 jobs created in April.

i guess the sovereign debt fears are overriding any optimism that shows in the jobs numbers.

Re: Perspectives on the global economic meltdown (Jan 26 201

Hari garu: Some eggsperts believe that the b/d numbers cannot be directly subtracted, unlike the census hiring numbers. Some eKonmics are heartened that the household survey, that is used to get the unemployment rate, has shown better job numbers than the business survey. These eggsperts are of the opinion that household survey is often the first to detect any job recovery than the business survey. And, that is because the household survey picks up trends of hiring in start-ups. In addition the household survey is more inclusive because it counts workers that do not get counted in the business surveys like self-employed, agricultural workers ityadi

Since it is the 'perspective' dhaaga and not raw data dhaaga, we need to be aware these are numbers from surveys and polls. And analysts, politicians & BRFites can slice and dice these to suit their ideologies and claims. Remember all is maya onlee

Since it is the 'perspective' dhaaga and not raw data dhaaga, we need to be aware these are numbers from surveys and polls. And analysts, politicians & BRFites can slice and dice these to suit their ideologies and claims. Remember all is maya onlee

Re: Perspectives on the global economic meltdown (Jan 26 201

Is there fraud going on in the US stock market?

The 1,000 point DOW plunge is being explained as human error. The 'fat finger' or typo where they entered 'B' behind the sell order for billion instead of 'M' for million is to blame.

The question noone seem inclined to ask is how can billions of stock shares be sold by someone who obviously doesn't own billions of shares? Short sellers are supposed to borrow the shares before they sell short. Again, it is obvious this did not happen. Accenture, a $30 stock got down to $0.10 because they sold many more shares than exists.

The reality of naked short selling is that once you get to a certain level of trading you can sell now, worry about finding shares later, if ever. This gives those traders the ability to create shares from thin air, driving the price down, running the stops of the legitimate shareholders forcing them to sell for no reason. Of course, once the legitimate shareholders sell, the shorts are free to cover making huge profits.

This is fraud and the market accepts it.

The 1,000 point DOW plunge is being explained as human error. The 'fat finger' or typo where they entered 'B' behind the sell order for billion instead of 'M' for million is to blame.

The question noone seem inclined to ask is how can billions of stock shares be sold by someone who obviously doesn't own billions of shares? Short sellers are supposed to borrow the shares before they sell short. Again, it is obvious this did not happen. Accenture, a $30 stock got down to $0.10 because they sold many more shares than exists.

The reality of naked short selling is that once you get to a certain level of trading you can sell now, worry about finding shares later, if ever. This gives those traders the ability to create shares from thin air, driving the price down, running the stops of the legitimate shareholders forcing them to sell for no reason. Of course, once the legitimate shareholders sell, the shorts are free to cover making huge profits.

This is fraud and the market accepts it.

Re: Perspectives on the global economic meltdown (Jan 26 201

What is naked shorting? Is that using put options?

Re: Perspectives on the global economic meltdown (Jan 26 201

Methinks this plan would even work to solve the Pakistani terrorism problem.Hari Seldon wrote: To which Sri Denninger responds:ROFL onlee.The solution is simple. I offer up the following three point plan:

1.

Stop lying

2.

Stop lying

3.

Stop lying

That's it.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

swamy garu,SwamyG wrote:Since it is the 'perspective' dhaaga and not raw data dhaaga, we need to be aware these are numbers from surveys and polls. And analysts, politicians & BRFites can slice and dice these to suit their ideologies and claims. Remember all is maya onlee

I broadly agree. Mish asserts that organic popn growth itself requires a certain level of job creation just to keep level. Yes, the household survey is more inclusive and often a better forward indicator of real hiring. If it's happening, good and more power to whatever is working in the khanate.

BTW, am personally on a quest to 'unlearn' ideological proclivities in khanomics of late. Would help detect changes that ideological blinkers would not catch onlee. Am also coming round to the view that the worst of the crisis is over for the khanate. A big bullet has been dodged, for once there genuinely was the possibility of a loss of control of events. That has passed. Whatever now will come can be much more easily handled, IMVHO. Of course, that doesn;t meana return to the heady pre-2007 era. More in the nature of a slow, long slog. But no contraction, no depression, no contagion, no disaster. "whew". Or so I hope. The headiness and giddiness of pre-2007 was debt-induced and rather fake. Time to get to a more sustainable, new normal. Jai ho.

Re: Perspectives on the global economic meltdown (Jan 26 201

I am reading the book "Liars Poker" about the rise and fall of salomon brothers through the eyes of a trainee. some of the descriptions are truly hilarious of personalities in that co. like the gang of rough riding mortgage bond traders who started with onion cheeseburgers in the morning, ate all day and every friday had a "feeding frenzy" with $400 worth of mexican food incl 5 gallon jugs of guacamole....

historically - it seems they pioneered the concept of "slicing and dicing" mortages into saleable bonds, raped all the small banks who used to extend retail mortgages, dominated the bond market for many years and made pots of money for the lucky and audacious before flaming out. Paul Volcker is mentioned as pushing some legislation that made the bond market boom.

historically - it seems they pioneered the concept of "slicing and dicing" mortages into saleable bonds, raped all the small banks who used to extend retail mortgages, dominated the bond market for many years and made pots of money for the lucky and audacious before flaming out. Paul Volcker is mentioned as pushing some legislation that made the bond market boom.

Re: Perspectives on the global economic meltdown (Jan 26 201

Definitely a fun book. I believe it was Ranieri's division that aggregated mortgages and sold them in tranches.

I think doing the same with microfinance is also a possibility. Pooling together thousands of micro loans and using them to back securities. Will solve world hunger.

I think doing the same with microfinance is also a possibility. Pooling together thousands of micro loans and using them to back securities. Will solve world hunger.

Re: Perspectives on the global economic meltdown (Jan 26 201

Next will come the political crisis or confrontation - as occurred following the first couple of Clinton years. A Republican-leaning Congress will then increasingly butt heads with the Dem Whitehouse, bringing paralysis in Washington.Hari Seldon wrote:BTW, am personally on a quest to 'unlearn' ideological proclivities in khanomics of late. Would help detect changes that ideological blinkers would not catch onlee. Am also coming round to the view that the worst of the crisis is over for the khanate. A big bullet has been dodged, for once there genuinely was the possibility of a loss of control of events. That has passed. Whatever now will come can be much more easily handled, IMVHO. Of course, that doesn;t meana return to the heady pre-2007 era. More in the nature of a slow, long slog. But no contraction, no depression, no contagion, no disaster. "whew". Or so I hope. The headiness and giddiness of pre-2007 was debt-induced and rather fake. Time to get to a more sustainable, new normal. Jai ho.

If the slide of the US into recession had accelerated moves towards outsourcing for cost-savings, then I wonder if a European recession will accelerate European outsourcing to India/etc? I don't see where Europeans are going to get these promised budget-reductions from.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

EU's Financial Services Chief To Probe Credit Rating Agencies

Basically, the EU's upset with Moody's S&P etc and is now threatening to create its own rating agency. Pls to do so I say. bout time, every major trading bloc had its own 'official' rating agency. Now we are talkling real shake-ups in the established khanomic order. Sure, the risk in countries like PRC owning rating agencies is that the agency will rate whatever Beijing will tell it to. Theek hai. Its a free mkt of credibility - let each agency build its own.

Basically, the EU's upset with Moody's S&P etc and is now threatening to create its own rating agency. Pls to do so I say. bout time, every major trading bloc had its own 'official' rating agency. Now we are talkling real shake-ups in the established khanomic order. Sure, the risk in countries like PRC owning rating agencies is that the agency will rate whatever Beijing will tell it to. Theek hai. Its a free mkt of credibility - let each agency build its own.

"I think we need to go further to look at the impact of the ratings on the financial system or economic system as a whole...," European Internal Markets Commissioner Michel Barnier told members of the European Parliament.

"If you look at Greece, for example, I was quite surprised by the quite rapid deterioration in rating."

As the European commissioner in charge of financial services regulation, Barnier could propose new rules governing rating agencies. He said on Tuesday it could be possible to start a European agency to rate countries' creditworthiness.

Re: Perspectives on the global economic meltdown (Jan 26 201

It would be nice to have independent ratings agencies, rather than each trading bloc having its own favorite son.

The best way to have independence among ratings agencies is to have as many of them as possible. If you can have so many independent analysts rating/recommending stocks to buy or sell, why can't there be more bond raters?

The best way to have independence among ratings agencies is to have as many of them as possible. If you can have so many independent analysts rating/recommending stocks to buy or sell, why can't there be more bond raters?

Re: Perspectives on the global economic meltdown (Jan 26 201

Liar's Poker is a great book - I have unsuccessfully trying to find a el-cheapo used copy at friends of library sales for years now. Most of those legendary traders at Salomon Brothers were fairly uneducated men (in terms of formal education) with no fancy Haahvuhd degrees and flashy class rings - what they had was extreme street smarts and b@lls the size of Musharraf's head and unfortunately a belieft that they could get away with it all.Singha wrote:I am reading the book "Liars Poker" about the rise and fall of salomon brothers through the eyes of a trainee. some of the descriptions are truly hilarious of personalities in that co. like the gang of rough riding mortgage bond traders who started with onion cheeseburgers in the morning, ate all day and every friday had a "feeding frenzy" with $400 worth of mexican food incl 5 gallon jugs of guacamole....

Re: Perspectives on the global economic meltdown (Jan 26 201

shorting requires that you have the security so you can sell it now and buy it back later.Carl_T wrote:What is naked shorting? Is that using put options?

a naked short is where you don't have that security to sell but you enter a short position anyway. this is illegal.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

El-Erian on a critical weekend for Europe and the economy

On FT's alphaville.

El-Erian's a worth listening to guy. CEO and co-CIO of PIMCO.

Here's the meat of his analysis:

On FT's alphaville.

El-Erian's a worth listening to guy. CEO and co-CIO of PIMCO.

Here's the meat of his analysis:

Let's be clear, the odds of a ECB+IMF drownout are very slim only. IMHO, in the worst case ECB will tearup its rule-book and start QE of its own, i.e. start buying EU bonds. But thats a far cry at the moment. I'm hoping the oiros for once manage their books in an orderly way. The alternative could be renewed turmoil with multiple nations and people hit by debt-deflation and dragged into depression.As the announcements multiply, it is even more important to be clear about the key question. This is best summarized by a simple, and disturbing image, that a friend alerted me to:

With Greece (as well as Portugal and some other countries) now visibly drowning in a sea of debt, the question is whether the rescuer (EU/IMF) can pull off the rescue or, instead, get pulled down with all parties drowning.

OK. We wait and see (as if we had any other options:))So far, the attempts at rescue-including last Sunday’s dramatic EUR 110 billion announcement-have have been incomplete with respect to both design and implementation. They were thus viewed as insufficient and not credible by analysts and markets. As a result, the Greek crisis morphed in the following days into something much more sinister for Europe and the global economy.

This explains this weekend’s shift in the EU to a “whatever it takes” mindset. We are seeing evidence of a significant step-up in crisis management. Yet the question is not whether a step-up is required-it clearly is. The question is whether the strengthened rescue attempt will prove sufficient.

Has the rescuer been bolstered enough to pull out the drowning parties, or will the latest rescuer be pulled down too?

It is too early to make this call with a sufficient degree of foundation and conviction. At the very minimum, we have to wait for tomorrow’s operational details.

Yup fingers crossed on this one. Jai ho.Even with this critical uncertainty, we should not under-estimate the historical relevance of what is happening this weekend; and the stakes for Europe and the global economy are huge.

If this rescue attempt does not work, there will be a material acceleration in the process of change to Europe’s economic, financial, and institutional landscape; and the reality of the debt explosion in industrial economies will become even more of a destabilizing factor for the world economy.

Re: Perspectives on the global economic meltdown (Jan 26 201

Emailed to me:

The Wall Street Journal (online) said "exchange operators maintain that their systems and customers experienced no technical glitches that might have prompted the selloff." The Journal further states in their article that regulators are searching for something, "after exchanges reviewed their audit trials and so far have found nothing indicating a massive, erroneous trade that touched off the chaos." In other words, investors and market followers cannot believe that the stock market can fall for "no reason."

The Wall Street Journal (online) said "exchange operators maintain that their systems and customers experienced no technical glitches that might have prompted the selloff." The Journal further states in their article that regulators are searching for something, "after exchanges reviewed their audit trials and so far have found nothing indicating a massive, erroneous trade that touched off the chaos." In other words, investors and market followers cannot believe that the stock market can fall for "no reason."

Re: Perspectives on the global economic meltdown (Jan 26 201

Probably dodged a bullet for now one can say. But just like one is destined for death when one is born, so are countries. Except that death for countries does not mean total death, but possibly losing power & influence. The inevitable can just be pushed. We probably don't care if the inevitable happens 200-300years from now. The question is will it happen in this century. The Census 2010 will offer interesting population details and statistics.Am also coming round to the view that the worst of the crisis is over for the khanate. A big bullet has been dodged, for once there genuinely was the possibility of a loss of control of events. That has passed.

Re: Perspectives on the global economic meltdown (Jan 26 201

Good commentary by Niall Ferguson:

The End of the Euro

How the crisis in Greece could lead to the demise of Europe's most ambitious project.

The End of the Euro

How the crisis in Greece could lead to the demise of Europe's most ambitious project.

Re: Perspectives on the global economic meltdown (Jan 26 201

Merkel's CDU Loses Key State Election

"The result may cost Merkel her majority in the upper house of parliament in Berlin, where Germany’s 16 states are represented, making it harder to push through legislation such tax cuts, health-care reform and extending the lifespan of nuclear-power plants."

"The result may cost Merkel her majority in the upper house of parliament in Berlin, where Germany’s 16 states are represented, making it harder to push through legislation such tax cuts, health-care reform and extending the lifespan of nuclear-power plants."

Re: Perspectives on the global economic meltdown (Jan 26 201

Sanjay M wrote:Good commentary by Niall Ferguson:

Nothing new in that article. He's just rehashing the info already in the news for weeks now.

-

Chinmayanand

- BRF Oldie

- Posts: 2585

- Joined: 05 Oct 2008 16:01

- Location: Mansarovar

- Contact:

-

Chinmayanand

- BRF Oldie

- Posts: 2585

- Joined: 05 Oct 2008 16:01

- Location: Mansarovar

- Contact:

Re: Perspectives on the global economic meltdown (Jan 26 201

btw i don't think anything will happen to Goldman Sachs. The SEC investigation is just a road show. GS will end up paying a small fine and nothing more. They will be back to gaming the system as per usual schedule thereafter.

Re: Perspectives on the global economic meltdown (Jan 26 201

Here comes Euro-TARP (aka. TARP for Sovereign Debtors)Chinmayanand wrote:EU Readies Emergency Fund Said to Be $645 Billion to Fight Off `Wolfpack'

http://www.businessinsider.com/500-bill ... fund2010-5

And here comes the fall of Merkel's party, the CDU.

Re: Perspectives on the global economic meltdown (Jan 26 201

Read his latest book,"The Big Short" - Inside the Doomsday Machine - , published in 2010, gives a blow by blow account of the subprime trigger that blew up the financial world.I am reading the book "Liars Poker"...

If you want a comprehensive empirical look at whats happening now - especially sovereign risk - you must read "This Time is Different" - Eight Centuries of Financial Folly by Carmen Reinhart and Kenneth Rogoff

Re: Perspectives on the global economic meltdown (Jan 26 201

The Big Short: Inside the Doomsday Machine

Michael Lewis (Author)

Michael Lewis (Author)

When the crash of the U. S. stock market became public knowledge in the fall of 2008, it was already old news. The real crash, the silent crash, had taken place over the previous year, in bizarre feeder markets where the sun doesn’t shine, and the SEC doesn’t dare, or bother, to tread: the bond and real estate derivative markets where geeks invent impenetrable securities to profit from the misery of lower- and middle-class Americans who can’t pay their debts. The smart people who understood what was or might be happening were paralyzed by hope and fear; in any case, they weren’t talking.

The crucial question is this: Who understood the risk inherent in the assumption of ever-rising real estate prices, a risk compounded daily by the creation of those arcane, artificial securities loosely based on piles of doubtful mortgages? Michael Lewis turns the inquiry on its head to create a fresh, character-driven narrative brimming with indignation and dark humor, a fitting sequel to his #1 best-selling Liar’s Poker. Who got it right? he asks. Who saw the real estate market for the black hole it would become, and eventually made billions of dollars from that perception? And what qualities of character made those few persist when their peers and colleagues dismissed them as Chicken Littles? Out of this handful of unlikely—really unlikely—heroes, Lewis fashions a story as compelling and unusual as any of his earlier bestsellers, proving yet again that he is the finest and funniest chronicler of our times.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Enfant terrible sri tyler durden of zero hedge warns of renewed D&G risk. IMO, the risk has passed, tyler bhai. Its OK to heave relief sighs and chill with some Bordeux now.

Treasury Redeems $144 Billion In Bills In First Four Days Of May

Jai ho.

Treasury Redeems $144 Billion In Bills In First Four Days Of May

OK. So what is my question. In the kingdom of the blind the 1-eyed one is king. Unkil's almighty dollah *is* definitively the safest (relatively) fiat asset in the whole wide world. So there. All those institutional investors, pension funds, bond funds and the like - where will they go end of the day but to USTs?A few days ago we reported, quite stunned, that the US Treasury had redeemed nearly $600 billion in Bills in the month of April. Alas, the side-effects of an massively short-maturity heavy bond curve will be here to haunts us for a long time: according to today's DTS, in the first 4 business days of May alone, the UST has redeemed $144 billion in Bills. Annualized this number is surely something that even Richard Feynman would not joke about. We have gotten to the point where the roll issue is not a monthly concern, but is becoming a weekly funding threat, and even daily.

UKstan->germany->US is like this 1 tenuous connection built on tenuous connection only. Doesn't stack up into a plausible story, seems like. Odds are nothing will happen. IMVHO, of course.Of course, as we speculated in December, what better way to raise demand for Treasuries than to stage an equity selloff.Well, we got our selloff, and the 10 Year was trading in the lower 3% range today. {Hooray! No?}

However, the risk now is how the sovereign fire will spread through the periphery and into the core. Already, we are seeing that CDS traders are massively betting on a collapse of the UK as the next bastion of sovereign spending lunacy. And when the UK goes, Germany is next, shortly to be followed by Japan and the US.

Lite lo, sir. The war bogey has been oversold and under-shorted. Nothing will happen. (Am I sounding like Jim Cramer, enough?)At that point the only buyer of US debt will be the US itself. Which will lead to the final outcome of massive consumer deflation as economic collapse finally strikes home, coupled with asset price hyperinflation, as a gallon of oil hits $10 (and helping the Dow hit 36,000). And as this is not an equilibrium state, the outcome will be, as it always is in these situations, war. :LOL:

Hopefully the US is good as it historically has been at finding its "deserving" opponent, WMDs aside. Otherwise, things may be a little rough for the great declining American civilization after the next 5 years.

Jai ho.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

UK-stan has pulled yet another rabbit outta its musharraf - fooled the markets yet again. At this trate, winning will become a habit for them like for the OZ kirket team. Here, judge for yourselves.

Greek Lessons for the New U.K. Prime Minister (Simon Nixon in wsj)

An let's be clear - a 200 bp jump in UK-stan's avg borrowing rate will entail what smt Hillary infamously called 'severe consequences' to bear only. UK-stan is not Yindia and doesn't quite have our immune system to benignly shrug off mkt shockas like that.

By the way, just by way of a thought experiment, what cuts are these so required of UQ (and you can clearly see why these are impractical to implement even in as disciplined, loyal, patriotic, awesome, tax-paying, honest, integrity-laden, noble (did I mention awesome?) nation as UK-stan? Let's stroll down possibility lane quickly:

Greek Lessons for the New U.K. Prime Minister (Simon Nixon in wsj)

See what I mean. The mkts have been exceedingly kind to UQ all these yrs, allowing them to borrow at low rates to ever higher debt-driven fake prosperity. In the process, it (the great moderation?) has hollowed the land's traditional immune defences to mkt shocks and swings of a violent nature.Politicians were fortunate that for the best part of a year investors and rating agencies effectively suspended judgment on the UK. It's unlikely the UK would have retained its AAA-rating or been allowed to borrow at less than 4% on the basis if the market had not believed tough action on the deficit would be taken after the election.

An let's be clear - a 200 bp jump in UK-stan's avg borrowing rate will entail what smt Hillary infamously called 'severe consequences' to bear only. UK-stan is not Yindia and doesn't quite have our immune system to benignly shrug off mkt shockas like that.

Bah. Show me the money, honey. I've lost count of the # times I've heard such dire forewarnings with zero followup. The UQ is not greece or portugal or some such piddly pipsqueak country. No? The UQ will persist, like always. No?It's only now the election is over that the real voting will begin. The futures market opened at 1AM Friday to allow investors to start trading as the election results came in. From now on, whoever emerges as Prime Minister will have his performance judged not by daily opinion polls but in real-time by the markets. And unless that performance is remarkably sure-footed, the judgment is likely to be brutal.

What blashphemy the bolded part be!The new Prime Minister should not kid himself that the UK is somehow a special case, immune to euro zone contagion. The UK may have a separate currency, an independent central bank and longer debt maturities than other troubled economies. But these will come in little use if the markets lose confidence.

We'll see when (and *if*) rubber meets road. History shows us over-clearly that UKstan is invincible.The UK, with gross debt of 72.9% of GDP and a deficit likely to reach 12.6% this year, the largest in the European Union, has no such capacity – and only the IMF to turn to for a bailout. {Now that can't be fun, can it?}

As Moody's points out in a new report, what makes the UK so vulnerable to a sovereign debt crisis is the weakness of its banking system. Including private and public sector debt, the UK is one of the most leveraged countries in the world of debt equivalent to [400%] of GDP and a banking system still highly dependent on wholesale funding.

Again, more yap-yap with little practical feasaibility. UQ will default, as it has done enough times in the past and reset to a new, fresh start. All this talk of austerity and cuts and crap won't fly in a democracy where even pakis have a legit vote.In the parallel universe of the campaign, Gordon Brown repeatedly claimed no other country was cutting spending this year. Back in the real world, Greece, Portugal, Spain and Ireland are doing just that. If the markets insist on cuts as deep as those countries – and the latest slide in the markets may force them to make deeper cuts still – then the new government really can expect, in the words of Bank of England Governor Mervyn King, to become so unpopular it is out of power for a generation.

By the way, just by way of a thought experiment, what cuts are these so required of UQ (and you can clearly see why these are impractical to implement even in as disciplined, loyal, patriotic, awesome, tax-paying, honest, integrity-laden, noble (did I mention awesome?) nation as UK-stan? Let's stroll down possibility lane quickly:

The easiest decision glate bitten's gubmint can take is boost immigration quotas fro pakistan. history shows that by screwing Indian interests, UQ usually benefits only.Putting up VAT by 3p in the pound will be the easiest decision the new Chancellor ever gets to take. How about cutting public sector pay by [10%], as Ireland has done? Or raising the retirement age by 14 years from 53 to 67, as Greece has done? The Tories in their manifesto proposed only to freeze public sector pay for one year; and the retirement age will rise by just one year to 66 only in 2016. Far tougher measures will be required to convince the markets the UK is serious about tackling its problems.

Bah, nothing will happen. We'll see. Time will tell in its own sweet time. Jai ho.The euro zone does offer some clues as to what may be required of the new government. For example, until the latest slide, Ireland remained largely unscathed by the sovereign debt crisis despite a wrecked banking system and a huge deficit, which demonstrates the credibility to be gained by taking tough actions early. And Wednesday's joint statement by both Spain's main political parties on banking sector reform underlined the need to seek as wide a national consensus as possible for the most difficult measures. Whoever "wins" the election is unlikely to feel like a winner for long. Voters will return from their holiday from reality to find the house has been ransacked. A new dawn indeed.

Re: Perspectives on the global economic meltdown (Jan 26 201

>> raising the retirement age by 14 years from 53 to 67

talk about being worked to death.

talk about being worked to death.