Perspectives on the global economic meltdown (Jan 26 2010)

Re: Perspectives on the global economic meltdown (Jan 26 201

I had mentioned how uncle was addicted to slave labor and how the US economy was built on that. Our friend Papa, (more of papi, because evangelicals believe that we are born sinners, hence papi) Jones was furious at that observation.

Recently National Geographic ran a series (in US) called The Story of US.

The story confirmed the fact that the cotton picking slaves contribution to US GDP.

This was replaced by Hispanic population from Mexico, Honduras, Guatemala etc. for Orange and citrus cultivation.

Recently National Geographic ran a series (in US) called The Story of US.

The story confirmed the fact that the cotton picking slaves contribution to US GDP.

This was replaced by Hispanic population from Mexico, Honduras, Guatemala etc. for Orange and citrus cultivation.

Re: Perspectives on the global economic meltdown (Jan 26 201

Fed - please start buying high quality corporate debt instead of treasuries, and please focus on printing as much money as possible and injecting it into the economy. Money supply needs to increase.

The Fed (God) is all powerful but mysterious are its ways.

The Fed (God) is all powerful but mysterious are its ways.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Aaj ka TAE tweet roundup

http://twitter.com/AutomaticEarth

I've heard way too many D&G pronouncements to get unjaded now. This too shall pass. Wake me when there is significant social unrest. Until then, its all hot air only.

Thats it for today, I guess. Hajaar work coming up, loaded day. ciao till the evening.

P.S.

I that the propose the war-cry of this thread should be "Dollahoakbar!"

Jai ho.

http://twitter.com/AutomaticEarth

Deflation it is and may take yrs to play out. USTs and gubmint bonds will do well for a long time, IMO, even though yields relative to the bubble yrs won't be anything like attractive.Hedge funds develop taste for US Treasury bonds http://bit.ly/98einq Now account for 20pc of all volume in the $10 Trillion market

TAE 11/8: At least 36 of the 100-largest U.S. prime money-market funds had to be propped up in order to survive the financial crisis

Nicholas Nassim Taleb is "betting on the collapse of government bonds" and that investors should avoid stocks. http://bit.ly/cnxuxg

Deflationary fears send Treasuries off charts http://bit.ly/bYhByY 10 year is below 2.8pc.

Yup, the ridiculuous higher ed bubble burst is long overdue. And its happening exactly when lower ed is also facing huge strains - mainly relating to teacher+administrator retirements and pensions that have taxpayers on the hook. This unwind won't be pretty, IMO.TAE 11/8: Consumers now owe more on their student loans than their credit cards, $829.79 Bn vs $826.5 Bn #ridiculous

"The Fed doesn't support you, the American people, it supports the zombie banking system at your cost." Ilargi

"If no-one's borrowing, the overall money supply goes down. That spells deflation, and the Fed is powerless against it." Ilargi

"The only thing QE1 achieved, again, was to prop up banks." Ilargi

Analysis: Fast-fading recovery now looks even weaker http://bit.ly/dh3lNk There never was a recovery, it was a cover up at your expense

OMG, couldn't resist but LOLing at this one only. Even the TFTAs when poushed into a corner like the one the yooyes currently is in start talking like SDRE neta-babus, seems like.Spin, baby spin! The US posts a $165 Billion deficit in July and the spinners say it's better by $4Billion YoY. What mangled standards

Yes, some states - CA, FL are hard hit. But this kinda doomy scenario thankfully won't visit the mainstream/heartland anytime soon, IMHO.Where recession's effects are magnified: East of SF, jobless rates go up to 20%, home prices are down as much as 75% http://bit.ly/9Oofwq

Yawn. All talk and no play makes chang a dull boy. LOL.Chinese General Says U.S. Provocation Risks Economic Response http://bit.ly/bmz2qr The US sending an aircraft carrier to Yellow sea

Yawn.Personal income took a hit in most of the U.S. last year with the only gains coming from government support http://bit.ly/cmaMmF Nifty table

The U.S. will not remain a stable society if this great employment crisis is not addressed head-on — and soon. http://bit.ly/bmOiqU

I've heard way too many D&G pronouncements to get unjaded now. This too shall pass. Wake me when there is significant social unrest. Until then, its all hot air only.

Thats it for today, I guess. Hajaar work coming up, loaded day. ciao till the evening.

P.S.

I that the propose the war-cry of this thread should be "Dollahoakbar!"

Jai ho.

Re: Perspectives on the global economic meltdown (Jan 26 201

Does anyone work in equity research?

Re: Perspectives on the global economic meltdown (Jan 26 201

Its as meaningful as dice rolling in many cases.Carl_T wrote:Does anyone work in equity research?

Re: Perspectives on the global economic meltdown (Jan 26 201

I am SHOCKED at the gross disrespect that I see exhibited on this thread towards expert financial managers with their vast experience and indubitable Quantitative Targeting skills. Shame! Shame!

On a different note, I see that Neshant's thesis is being widely read and repeated all over the 'net these days.

On a different note, I see that Neshant's thesis is being widely read and repeated all over the 'net these days.

Re: Perspectives on the global economic meltdown (Jan 26 201

Neshant's thesis is all the rage these days. Had an argument with my friend about it the other day, he was calling for Ron Paul to be president(!) in '12 and demanding for the Fed to be scrapped and go back to gold standard. O well...

Re: Perspectives on the global economic meltdown (Jan 26 201

A few years ago, I was interviewed by a certain giant pension fund which did a whole lot of number crunching on super computers to generate results which were used to make investment decisions.

I got through the preliminary interview, did well on the technical interview... but blew it when it came time to face the top 2 managers.

Just before they were about to welcome me on board, mischieve got the better of me. With the lethal combination of being young & stupid, I decided to throw in an ill-timed commentary.

I asked them with all the super-computing and number crunching, if at the back of their minds they ever wondered if what they were building was the world's largest random number generator.

I still remember their expression of shock as both managers' faces as they turned towards each other in horror and then loooked back at me in disbelief. At that point, I thought to myself - "whoops... i shouldn't have said that".

I didn't get the job but last I heard, they are 30 billion dollars in the hole. The 'good' (?) news is that since its a public sector pension fund, the loss can be safely passed on to suckers down the line (namely taxpayers) who are obligated by law to pay the 'shortfall'.

I got through the preliminary interview, did well on the technical interview... but blew it when it came time to face the top 2 managers.

Just before they were about to welcome me on board, mischieve got the better of me. With the lethal combination of being young & stupid, I decided to throw in an ill-timed commentary.

I asked them with all the super-computing and number crunching, if at the back of their minds they ever wondered if what they were building was the world's largest random number generator.

I still remember their expression of shock as both managers' faces as they turned towards each other in horror and then loooked back at me in disbelief. At that point, I thought to myself - "whoops... i shouldn't have said that".

I didn't get the job but last I heard, they are 30 billion dollars in the hole. The 'good' (?) news is that since its a public sector pension fund, the loss can be safely passed on to suckers down the line (namely taxpayers) who are obligated by law to pay the 'shortfall'.

-

derkonig

- BRFite

- Posts: 951

- Joined: 08 Nov 2007 00:51

- Location: Jeering sekular forces bhile Furiously malishing my mijjile @ Led Lips Mijjile Malish Palish Parloul

Re: Perspectives on the global economic meltdown (Jan 26 201

What are you looking for, hain? Besides, hopefully Hussain Nobama will be headed they way of Down Jones this Nov.Carl_T wrote:Does anyone work in equity research?

Re: Perspectives on the global economic meltdown (Jan 26 201

I am looking for junior positions and snagged an interview, and I was hoping someone could send me a research report so I can sound knowledgeable.derkonig wrote:What are you looking for, hain? Besides, hopefully Hussain Nobama will be headed they way of Down Jones this Nov.Carl_T wrote:Does anyone work in equity research?

-

Christopher Sidor

- BRFite

- Posts: 1435

- Joined: 13 Jul 2010 11:02

Re: Perspectives on the global economic meltdown (Jan 26 201

The American are fretting about the Japans lost decade. They fear that they will also have to go through a similar time. Just to recap, in Japan's lost decade, growth slowed to zero, consumer spending turned negative, with households concentrating on savings rather than spending, and debt has risen to 100-150% of the GDP. The GDP debt figures vary according to the person asked. This is the nature of financial crisis and its aftermath.

However there is something which the yanks are already overlooking. They already had close to a lost decade. From 2001-2009, the real economy grew very slowly. The only sector which grew in this time frame, it seems was the financial sector. Even now the financial sector of america is the biggest component of the economy of America. It is as if that america has transformed into a huge bank, whose sole purpose is to arrange for finance for itself and the world. The financial sector which was supposed to one of the helpers of modern economy, one of the pillars. But the pillar has now become the economy.

Another disturbing fact, which did not go noticed, is that the stock market crash of 2008-09 wiped out the entire gains which the american economy made in the decade, 2001-2009. Never since the great depression has this happened. In fact in all of the recessions which America had faced, after the great depression, if the stock market had gained say something like 100 points, then in all the recession (1979,1984,1989, etc) it lost only 50 or 75 points. The gain of 50-25 points the stock market still retained. But in this panic of 2008-09 the stock market lost the entire 100 points.

Something similar happened to India also, where the SENSEX fell from 21000 to 8-9000 points. The last time sensex was around 8-9000 points happened in 2005. Off course for India the stock market is not exactly the most reliable way to measure the growth of india's economy.

A disturbing parallel can be drawn with great Britain in 1900s. Are we actually seeing the demise of a super power ?

However there is something which the yanks are already overlooking. They already had close to a lost decade. From 2001-2009, the real economy grew very slowly. The only sector which grew in this time frame, it seems was the financial sector. Even now the financial sector of america is the biggest component of the economy of America. It is as if that america has transformed into a huge bank, whose sole purpose is to arrange for finance for itself and the world. The financial sector which was supposed to one of the helpers of modern economy, one of the pillars. But the pillar has now become the economy.

Another disturbing fact, which did not go noticed, is that the stock market crash of 2008-09 wiped out the entire gains which the american economy made in the decade, 2001-2009. Never since the great depression has this happened. In fact in all of the recessions which America had faced, after the great depression, if the stock market had gained say something like 100 points, then in all the recession (1979,1984,1989, etc) it lost only 50 or 75 points. The gain of 50-25 points the stock market still retained. But in this panic of 2008-09 the stock market lost the entire 100 points.

Something similar happened to India also, where the SENSEX fell from 21000 to 8-9000 points. The last time sensex was around 8-9000 points happened in 2005. Off course for India the stock market is not exactly the most reliable way to measure the growth of india's economy.

A disturbing parallel can be drawn with great Britain in 1900s. Are we actually seeing the demise of a super power ?

-

derkonig

- BRFite

- Posts: 951

- Joined: 08 Nov 2007 00:51

- Location: Jeering sekular forces bhile Furiously malishing my mijjile @ Led Lips Mijjile Malish Palish Parloul

Re: Perspectives on the global economic meltdown (Jan 26 201

OT for this dhaaga, but i-banks of all shapes & sizes usually have equity research divisions, so visit their websites. Could you be a bit more specific about what type of report are you looking for? A stock/instrument/commodity/market specific report? Any time frames like weekly calls, annual targets, etc.?Carl_T wrote:I am looking for junior positions and snagged an interview, and I was hoping someone could send me a research report so I can sound knowledgeable.

The real evil chankian bania-brahmin

Last edited by derkonig on 12 Aug 2010 10:50, edited 1 time in total.

Re: Perspectives on the global economic meltdown (Jan 26 201

I'm looking for a research report on a stock of any timeframe. I've a feeling I'm going to be asked to pitch some investment opportunities because I detailed my investment strategy in my application. So I'm just looking to get an idea of what research reports involve in terms of data and analysis so I can break my analysis down the same way and make myself come across as a good fit for the position.

Re: Perspectives on the global economic meltdown (Jan 26 201

The horror on their face was because you knew what they knew and you were not supposed to .. know.

Re: Perspectives on the global economic meltdown (Jan 26 201

better make it Dole ho Akbar

-

derkonig

- BRFite

- Posts: 951

- Joined: 08 Nov 2007 00:51

- Location: Jeering sekular forces bhile Furiously malishing my mijjile @ Led Lips Mijjile Malish Palish Parloul

Re: Perspectives on the global economic meltdown (Jan 26 201

Do look up reports on the stocks, etc. that you have suggested in your app.

The key areas of the report for a company are:

1. Analysis of recent news (Earning season is just getting over, so use company results)

a. Talk about the company nos., compare with historicals, look for trends, any break from existing trends

2. Sector overview (compare & contrast with your company's performance), competitor overview

3. Future trends for sector i.e. where would the business come from, biz growth, etc.

4. Go back to your co., analyze how would it perform as per the future trends identified, try to model financials for your co. based on the future trends identified.

5. Give price recommendation & trading calls based on the analysis done

And do add the executive summary in the beginning.. AoA

AoA

The key areas of the report for a company are:

1. Analysis of recent news (Earning season is just getting over, so use company results)

a. Talk about the company nos., compare with historicals, look for trends, any break from existing trends

2. Sector overview (compare & contrast with your company's performance), competitor overview

3. Future trends for sector i.e. where would the business come from, biz growth, etc.

4. Go back to your co., analyze how would it perform as per the future trends identified, try to model financials for your co. based on the future trends identified.

5. Give price recommendation & trading calls based on the analysis done

And do add the executive summary in the beginning..

Re: Perspectives on the global economic meltdown (Jan 26 201

<quote> compare with historicals, look for trends</quote>

Past performance does not guarantee future results! Remember

Past performance does not guarantee future results! Remember

-

derkonig

- BRFite

- Posts: 951

- Joined: 08 Nov 2007 00:51

- Location: Jeering sekular forces bhile Furiously malishing my mijjile @ Led Lips Mijjile Malish Palish Parloul

Re: Perspectives on the global economic meltdown (Jan 26 201

The idea behind the comparison is to not *guarantee* results but to see if there there could be a break from the past. So you would need to compare with the cos. historical performace, also compare with the sector performance & look out for the situation in the cos. key markets.

Situations like entry into new markets, slowdown in key markets, launch of new offerings, rising competition, winning/losing customers, mergers & acquisitions can bring about that "break from the past" in the cos. future performance & in such a situation the co. will need to be re-rated.

So the idea is to correlate changes internal (within the co.) & external with the results & see if we can spot some divergence from the historical data.

Situations like entry into new markets, slowdown in key markets, launch of new offerings, rising competition, winning/losing customers, mergers & acquisitions can bring about that "break from the past" in the cos. future performance & in such a situation the co. will need to be re-rated.

So the idea is to correlate changes internal (within the co.) & external with the results & see if we can spot some divergence from the historical data.

Re: Perspectives on the global economic meltdown (Jan 26 201

Great, thanks a lot, I'll write a report of my own. What area of finance are you in?

-

derkonig

- BRFite

- Posts: 951

- Joined: 08 Nov 2007 00:51

- Location: Jeering sekular forces bhile Furiously malishing my mijjile @ Led Lips Mijjile Malish Palish Parloul

Re: Perspectives on the global economic meltdown (Jan 26 201

I destroy value

Re: Perspectives on the global economic meltdown (Jan 26 201

The point is Carl, what ever modelling you are going to use, moving averages, poison arrivals, etc. you are going to be constrained to use past data , the assumptions and conditions, variables that you attach importance makes or breaks your forecasting aka predictions. Predilection can mar predictions top down or bottom up.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

^^^ One of the unsaid but everpresent things about this crisis is the notion that the old models have maybe, possibly, perhaps broken down, irrevocably.

That duniya'll have to unlearn and all that, jedi ishtyle coz gyan of how things like different asset classes - equities, bonds, copmmodities, property etc - worked in the past is more likely to mislead, bias and unprepare one for the brave new world ahead. Perhaps.

Hari Om Hari Om Radheshyam Radheshyam

That duniya'll have to unlearn and all that, jedi ishtyle coz gyan of how things like different asset classes - equities, bonds, copmmodities, property etc - worked in the past is more likely to mislead, bias and unprepare one for the brave new world ahead. Perhaps.

Hari Om Hari Om Radheshyam Radheshyam

-

Satya_anveshi

- BRF Oldie

- Posts: 3532

- Joined: 08 Jan 2007 02:37

Re: Perspectives on the global economic meltdown (Jan 26 201

Looks like "the best car" has lost  {May the best car win campaign backfired and the GM CEO is stepping down}

{May the best car win campaign backfired and the GM CEO is stepping down}

Will the trade war with Japanese car makers dampens from here on or gets a boost is something to watch for.

Will the trade war with Japanese car makers dampens from here on or gets a boost is something to watch for.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

Okie, more fodder for what I was talking about in moi last post. Only.

The redoubtable Tim Price, writing on August 2 in an article called "Tales of the Unexpected", writes as follows:

Recent history, as in within the lifetime of anyone engaging with this commentary, is not necessarily up to the task of assessing the risks facing the modern investor, anywhere except Japan over the last two decades, the example of which does not exactly lend itself to any market view that could be described as bullish.... that free market capitalism worked. Some, if not all, of those assumptions have not survived their first serious contact with the enemy. We are increasingly accused of labouring what we perceive as the unusual if not unique "riskiness" of the current situation, as if we weren't already aware that sounding a continual note of extreme caution is not exactly conducive to encouraging new investment business. At the risk of appearing either trite or inadvertently offensive:

First the sub-prime assets sold off,

And I wasn't much bothered because I didn't own sub-prime assets.

Then the bank stocks sold off,

And I wasn't much bothered because I didn't own bank stocks.

Then the equity markets sold off,

And I wasn't much bothered because I have a diversified portfolio

.

Then Big Government stepped in and bailed out everybody,

And I got a little bothered because I believe in free markets and not the socialisation of banking losses.

Then government finances became imperiled,

And I got a little more bothered because there are only so many safe havens.

Then neo-Keynesian economists were allowed to dominate the debate,

And they shouted louder than everybody else for the creation of yet more debt.

Then quantitative easing threatened to go 24/7,

And I got a little more bothered because there are no good historical examples of unrestrained money-printing or currency debauchery that ended well.

Then the wheels well and truly fell off,

And by that time there was nowhere left to go.

Re: Perspectives on the global economic meltdown (Jan 26 201

Carl_T:

You can open an account at Fidelity and get access to a lot of research from different companies. That might be the best way to get access.

I suggest you focus on a company or a sector, and read all the reports you can about them. Then come up with your own thesis about the company. It is likely going to be a combination of what different analysts say.

You can open an account at Fidelity and get access to a lot of research from different companies. That might be the best way to get access.

I suggest you focus on a company or a sector, and read all the reports you can about them. Then come up with your own thesis about the company. It is likely going to be a combination of what different analysts say.

Re: Perspectives on the global economic meltdown (Jan 26 201

Carl_T, Google for Cornell Analysis of Enron. The four student research team that predicted its demise. Will post link once I find it.

LINK

The one with Enron disclaimer. File name ene.pdf

LINK

The one with Enron disclaimer. File name ene.pdf

Re: Perspectives on the global economic meltdown (Jan 26 201

Hmm!!! That takes a few paise, hain?You can open an account at Fidelity and get access to a lot of research from different companies. That might be the best way to get access.

Or you could go to http://www.yahoo.com, go to "Finance", put in some stock symbol (what's ENRON?) and you will get the basics of that stock, plus some links to "analysts' opinions" that will give all the same stuff as the reports that Fidelity links. It's all smoke and mirrors, anyway.

BEST BET:

Look at the FORUM for the stock, and you can see a good diversity of opinion, plus a lot of bots selling Karachi real estate etc.

In my long and sad experience, the hard-learned lesson is, sure, read the snooty Anal-ysts reports, but be SURE to get a true sense of the market by going to the Yahoo! forum for that stock and seeing all the "inside gossip" and misinformation before forming your buy or sell decision. Esp. sell decision.

Absolutely the WORST experience I have had is reading an Anal-yst Report from Raymond James Inc. that gave a STRONG BUY signal on the stock for some fly-by-nite telecom company. The stock symbol was NTELOS which should have told me it stood for NET LOSS

2 days b4 they went bankrupt. Not Chapter 11 protection, but bankrupt as in zero like ENRON. Lost enuf to set back my jalopy-replacement fund by many years.

Wouldn't have happened if I had browsed the forum and seen the comments from their employees etc.

Re: Perspectives on the global economic meltdown (Jan 26 201

Too many ‘GAAPS' { It would have been better if the title were to be Mind the GAAP }how business is conducted in the US? “You have two cows. You sell three of them to your publicly listed company, using letters of credit opened by your brother-in-law at the bank, then execute a debt/equity swap with an associated general offer so that you get all four cows back, with a tax exemption for five cows.”

http://www.thehindubusinessline.com/201 ... 191100.htm

-

vina

- BRF Oldie

- Posts: 6046

- Joined: 11 May 2005 06:56

- Location: Doing Nijikaran, Udharikaran and Baazarikaran to Commies and Assorted Leftists

Re: Perspectives on the global economic meltdown (Jan 26 201

Very Yummy eh, this YummandYea?derkonig wrote:I destroy value

-

derkonig

- BRFite

- Posts: 951

- Joined: 08 Nov 2007 00:51

- Location: Jeering sekular forces bhile Furiously malishing my mijjile @ Led Lips Mijjile Malish Palish Parloul

Re: Perspectives on the global economic meltdown (Jan 26 201

M&A Losers in $10 Trillion Deal Binge Led by McClatchy, Sprint

http://www.bloomberg.com/news/2010-08-1 ... extel.html

http://www.bloomberg.com/news/2010-08-1 ... extel.html

Re: Perspectives on the global economic meltdown (Jan 26 201

AoA! The Talibs have won.

U.S. Is Bankrupt and We Don't Even Know It: Laurence Kotlikoff

By Laurence Kotlikoff - Aug 10, 2010

Bloomberg Opinion

Let’s get real. The U.S. is bankrupt. Neither spending more nor taxing less will help the country pay its bills.

What it can and must do is radically simplify its tax, health-care, retirement and financial systems, each of which is a complete mess. But this is the good news. It means they can each be redesigned to achieve their legitimate purposes at much lower cost and, in the process, revitalize the economy.

Last month, the International Monetary Fund released its annual review of U.S. economic policy. Its summary contained these bland words about U.S. fiscal policy: “Directors welcomed the authorities’ commitment to fiscal stabilization, but noted that a larger than budgeted adjustment would be required to stabilize debt-to-GDP.”

But delve deeper, and you will find that the IMF has effectively pronounced the U.S. bankrupt. Section 6 of the July 2010 Selected Issues Paper says: “The U.S. fiscal gap associated with today’s federal fiscal policy is huge for plausible discount rates.” It adds that “closing the fiscal gap requires a permanent annual fiscal adjustment equal to about 14 percent of U.S. GDP.”

The fiscal gap is the value today (the present value) of the difference between projected spending (including servicing official debt) and projected revenue in all future years.

Double Our Taxes

....

Is the IMF bonkers?

No. It has done its homework. So has the Congressional Budget Office whose Long-Term Budget Outlook, released in June, shows an even larger problem.

‘Unofficial’ Liabilities

Based on the CBO’s data, I calculate a fiscal gap of $202 trillion, which is more than 15 times the official debt. This gargantuan discrepancy between our “official” debt and our actual net indebtedness isn’t surprising. It reflects what economists call the labeling problem. Congress has been very careful over the years to label most of its liabilities “unofficial” to keep them off the books and far in the future.

For example, our Social Security FICA contributions are called taxes and our future Social Security benefits are called transfer payments. The government could equally well have labeled our contributions “loans” and called our future benefits “repayment of these loans less an old age tax,” with the old age tax making up for any difference between the benefits promised and principal plus interest on the contributions.

The fiscal gap isn’t affected by fiscal labeling. It’s the only theoretically correct measure of our long-run fiscal condition because it considers all spending, no matter how labeled, and incorporates long-term and short-term policy.

$4 Trillion Bill

How can the fiscal gap be so enormous?

Simple. We have 78 million baby boomers who, when fully retired, will collect benefits from Social Security, Medicare, and Medicaid that, on average, exceed per-capita GDP. The annual costs of these entitlements will total about $4 trillion in today’s dollars. Yes, our economy will be bigger in 20 years, but not big enough to handle this size load year after year.

This is what happens when you run a massive Ponzi scheme for six decades straight, taking ever larger resources from the young and giving them to the old while promising the young their eventual turn at passing the generational buck.

Herb Stein, chairman of the Council of Economic Advisers under U.S. President Richard Nixon, coined an oft-repeated phrase: “Something that can’t go on, will stop.” True enough. Uncle Sam’s Ponzi scheme will stop. But it will stop too late.

And it will stop in a very nasty manner. The first possibility is massive benefit cuts visited on the baby boomers in retirement. The second is astronomical tax increases that leave the young with little incentive to work and save. And the third is the government simply printing vast quantities of money to cover its bills.

Worse Than Greece

Most likely we will see a combination of all three responses with dramatic increases in poverty, tax, interest rates and consumer prices. This is an awful, downhill road to follow, but it’s the one we are on. And bond traders will kick us miles down our road once they wake up and realize the U.S. is in worse fiscal shape than Greece.

Some doctrinaire Keynesian economists would say any stimulus over the next few years won’t affect our ability to deal with deficits in the long run.

This is wrong as a simple matter of arithmetic. The fiscal gap is the government’s credit-card bill and each year’s 14 percent of GDP is the interest on that bill. If it doesn’t pay this year’s interest, it will be added to the balance.

Demand-siders say forgoing this year’s 14 percent fiscal tightening, and spending even more, will pay for itself, in present value, by expanding the economy and tax revenue.

My reaction? Get real, or go hang out with equally deluded supply-siders. Our country is broke and can no longer afford no- pain, all-gain “solutions.”

(Laurence J. Kotlikoff is a professor of economics at Boston University and author of “Jimmy Stewart Is Dead: Ending the World’s Ongoing Financial Plague with Limited Purpose Banking.” The opinions expressed are his own.)

To contact the writer of this column: Laurence Kotlikoff at [email protected]

Re: Perspectives on the global economic meltdown (Jan 26 201

Reagan insider: 'GOP destroyed U.S. economy'

Commentary: How: Gold. Tax cuts. Debts. Wars. Fat Cats. Class gap. No fiscal discipline

View all Paul B. Farrell ›

http://www.marketwatch.com/story/reagan ... 2010-08-10

ARROYO GRANDE, Calif. (MarketWatch) -- "How my G.O.P. destroyed the U.S. economy." Yes, that is exactly what David Stockman, President Ronald Reagan's director of the Office of Management and Budget, wrote in a recent New York Times op-ed piece, "Four Deformations of the Apocalypse."

Get it? Not "destroying." The GOP has already "destroyed" the U.S. economy, setting up an "American Apocalypse."

Jobs recovery could take years

In the wake of Friday's disappointing jobs report, Neal Lipschutz and Phil Izzo discuss new predictions that it could be many years before the nation's unemployment rate reaches pre-recession levels.

Yes, Stockman is equally damning of the Democrats' Keynesian policies. But what this indictment by a party insider -- someone so close to the development of the Reaganomics ideology -- says about America, helps all of us better understand how America's toxic partisan-politics "holy war" is destroying not just the economy and capitalism, but the America dream. And unless this war stops soon, both parties will succeed in their collective death wish.

But why focus on Stockman's message? It's already lost in the 24/7 news cycle. Why? We need some introspection. Ask yourself: How did the great nation of America lose its moral compass and drift so far off course, to where our very survival is threatened?

We've arrived at a historic turning point as a nation that no longer needs outside enemies to destroy us, we are committing suicide. Democracy. Capitalism. The American dream. All dying. Why? Because of the economic decisions of the GOP the past 40 years, says this leading Reagan Republican.

Please listen with an open mind, no matter your party affiliation: This makes for a powerful history lesson, because it exposes how both parties are responsible for destroying the U.S. economy. Listen closely:

Reagan Republican: the GOP should file for bankruptcy

Stockman rushes into the ring swinging like a boxer: "If there were such a thing as Chapter 11 for politicians, the Republican push to extend the unaffordable Bush tax cuts would amount to a bankruptcy filing. The nation's public debt ... will soon reach $18 trillion." It screams "out for austerity and sacrifice." But instead, the GOP insists "that the nation's wealthiest taxpayers be spared even a three-percentage-point rate increase."

In the past 40 years Republican ideology has gone from solid principles to hype and slogans. Stockman says: "Republicans used to believe that prosperity depended upon the regular balancing of accounts -- in government, in international trade, on the ledgers of central banks and in the financial affairs of private households and businesses too."

No more. Today there's a "new catechism" that's "little more than money printing and deficit finance, vulgar Keynesianism robed in the ideological vestments of the prosperous classes" making a mockery of GOP ideals. Worse, it has resulted in "serial financial bubbles and Wall Street depredations that have crippled our economy." Yes, GOP ideals backfired, crippling our economy.

Re: Perspectives on the global economic meltdown (Jan 26 201

N^3, Opening a Fidelity account takes a couple of thousand at the most.

https://scs.fidelity.com/accounts/servi ... shtml.cvsr $2.5K

You can use them as a bank account so worth it.

While Yahoo forums can be good to get information about obscure companies, typically it is best to fade the retail.

https://scs.fidelity.com/accounts/servi ... shtml.cvsr $2.5K

You can use them as a bank account so worth it.

While Yahoo forums can be good to get information about obscure companies, typically it is best to fade the retail.

Re: Perspectives on the global economic meltdown (Jan 26 201

ramana wrote:Carl_T, Google for Cornell Analysis of Enron. The four student research team that predicted its demise. Will post link once I find it.

LINK

The one with Enron disclaimer. File name ene.pdf

Much appreciated, will look at it.

Re: Perspectives on the global economic meltdown (Jan 26 201

I see, are you an anal-e-ist or a yum be aye ass-o-ciate.derkonig wrote:I destroy value

-

derkonig

- BRFite

- Posts: 951

- Joined: 08 Nov 2007 00:51

- Location: Jeering sekular forces bhile Furiously malishing my mijjile @ Led Lips Mijjile Malish Palish Parloul

Re: Perspectives on the global economic meltdown (Jan 26 201

^^

What is your edu background piradher?

What is your edu background piradher?

Re: Perspectives on the global economic meltdown (Jan 26 201

Massaland seems to be in deflation in a way.

Most of the food chains have low cost options on the menu. They haven't reduced the prices on the existing menu, but they added new low priced items. The quantity served is less, but the cost is also less. If you do not have a big appetite they could be a good option.

A couple of clothing stores I buy at are now perennially at sale - store wide and on new merchandise.

But at the same time, the job market seems to be picking up. Software is almost hot again now, at lease in Silicon Valley. Few months ago, only people with 7 or 8 years of experience would get a look in. Now it has come down to 3 years.

Other jobs might be opening up too. I see many more cars in the parking lot at the train station. Trains are more crowded too.

But as they say, employment gain might be on the slower side.

Most of the food chains have low cost options on the menu. They haven't reduced the prices on the existing menu, but they added new low priced items. The quantity served is less, but the cost is also less. If you do not have a big appetite they could be a good option.

A couple of clothing stores I buy at are now perennially at sale - store wide and on new merchandise.

But at the same time, the job market seems to be picking up. Software is almost hot again now, at lease in Silicon Valley. Few months ago, only people with 7 or 8 years of experience would get a look in. Now it has come down to 3 years.

Other jobs might be opening up too. I see many more cars in the parking lot at the train station. Trains are more crowded too.

But as they say, employment gain might be on the slower side.

-

Hari Seldon

- BRF Oldie

- Posts: 9374

- Joined: 27 Jul 2009 12:47

- Location: University of Trantor

Re: Perspectives on the global economic meltdown (Jan 26 201

^^^ Good to hear job mkt pickup at least in fits and starts here and there. Thats how I would expect any recovery to start to form. And unless job growth picks up, nothing improves, period.

Meanwhile, on the doomier side, more Cassandra sermons from TAE.

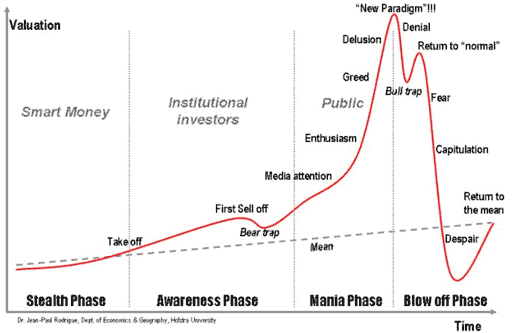

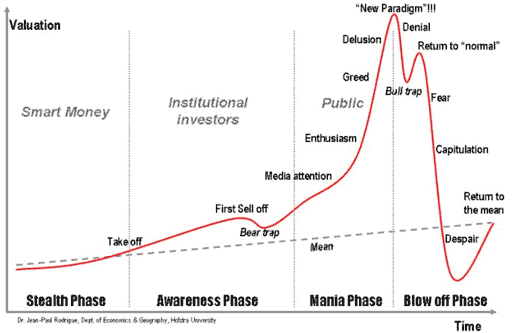

Bubble psychology

OK, so why do bubbles happen at all, eh?

Sri Henry Bloget writes:

Meanwhile, on the doomier side, more Cassandra sermons from TAE.

Bubble psychology

OK, so why do bubbles happen at all, eh?

oh, OK. But what is happening at the micro-level?"Some trends are persistent enough that they eventually attract a very wide pool of participants, as apparent gains amongst one's peers eventually overcome the caution even of many inherently skeptical people. When they last long enough to overcome the caution of bankers, the result is easy credit to fuel the fire, and a blatant disregard for systemic risk.

This is how the largest speculative bandwagons are formed - the ones that become manias and eventually lead to ruin for a large percentage of the population. Prices are continually pushed up, irrespective of any reasonable objective measure of value, by those who think that it doesn't matter how much they pay for something if there will always be a Greater Fool who will pay even more.

The evidence of pyramid dynamics - where insiders and early movers benefit at the expense of later generations destined to become empty-bag holders - should be abundantly clear. The pool of Greater Fools is not limitless."

The psychology of typical small-scale fluctuations plays out like this:

The psychology of a major bubble follows a similar pattern, but having risen to ridiculous levels of leverage, has very much further to fall. Much greater collective psychological extremes are experienced in a rare period of manic optimism, and its inevitable aftermath:

uh-oh. Ok, maybe. Let's hope not, though. There were many who predicted Malthusian doom and gloom in the 1900s only to see the miracle of industrial productivity raise living standards for vast masses of aam janta. Maybe some such miracle is round the corner, who knows?We are just past the point labeled 'Return to Normal', which corresponds to just after the end of the great sucker rally of 1930.

Sri Henry Bloget writes:

And Stoneleigh finishes:The rally that recently ended in April 2010 came after a crash that was actually slightly more severe than the 1929 crash (53% versus 48%). It took the market up nearly 80% from the low! The recent rally also lasted longer than the 1930 rally did--a year, as opposed to 6 months.[..]

Importantly, we won't know for sure what today's market is until we look at it with the genius of 20/20 hindsight. As Peter Schiff pointed out recently--and David Rosenberg observes today--even as late as 1931, they didn't know they were in a "Great Depression" yet. On the contrary, the promise from the White House was that "prosperity is just around the corner."

Ominous. But, let us withhold judgement. We'll see it beforfe we believe it, you say? We'll wait and see, then.Clearly we have a long way to fall in the next leg of deflationary deleveraging that is now underway, and the effects on the real economy will begin to be felt in the not too distant future.

Those who do not learn the lessons of history are destined to repeat them.

Re: Perspectives on the global economic meltdown (Jan 26 201

But Will It Make You Happy?

By STEPHANIE ROSENBLOOM

Published: August 7, 2010

http://www.nytimes.com/2010/08/08/busin ... f=business

Roko Belic, a filmmaker, moved from San Francisco to a trailer park in Malibu and now surfs often. He is working on a documentary about happiness.

SHE had so much.

A two-bedroom apartment. Two cars. Enough wedding china to serve two dozen people.

Yet Tammy Strobel wasn’t happy. Working as a project manager with an investment management firm in Davis, Calif., and making about $40,000 a year, she was, as she put it, caught in the “work-spend treadmill.”

So one day she stepped off.

Inspired by books and blog entries about living simply, Ms. Strobel and her husband, Logan Smith, both 31, began donating some of their belongings to charity. As the months passed, out went stacks of sweaters, shoes, books, pots and pans, even the television after a trial separation during which it was relegated to a closet. Eventually, they got rid of their cars, too. Emboldened by a Web site that challenges consumers to live with just 100 personal items, Ms. Strobel winnowed down her wardrobe and toiletries to precisely that number.

Her mother called her crazy.

Today, three years after Ms. Strobel and Mr. Smith began downsizing, they live in Portland, Ore., in a spare, 400-square-foot studio with a nice-sized kitchen. Mr. Smith is completing a doctorate in physiology; Ms. Strobel happily works from home as a Web designer and freelance writer. She owns four plates, three pairs of shoes and two pots. With Mr. Smith in his final weeks of school, Ms. Strobel’s income of about $24,000 a year covers their bills. They are still car-free but have bikes. One other thing they no longer have: $30,000 of debt.

Ms. Strobel’s mother is impressed. Now the couple have money to travel and to contribute to the education funds of nieces and nephews. And because their debt is paid off, Ms. Strobel works fewer hours, giving her time to be outdoors, and to volunteer, which she does about four hours a week for a nonprofit outreach program called Living Yoga.

“The idea that you need to go bigger to be happy is false,” she says. “I really believe that the acquisition of material goods doesn’t bring about happiness.”