Amber,

Thanks again for the links. Regarding nuclear power in the US, there's a combination of wistful thinking (by some otherwise knowledgeable posters who are too invested in the positions they have taken in this debate) and sheer ignorance and lack of understanding (among a few others).

For a 101 on US plans on nuclear power

this gives a good primer. And it's current, updated on June 6.

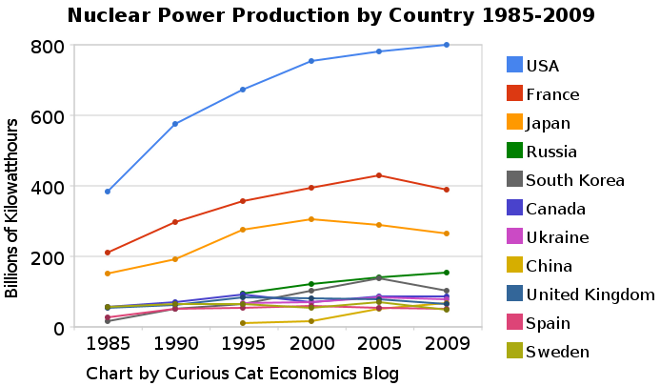

* The USA is the world's largest producer of nuclear power, accounting for more than 30% of worldwide nuclear generation of electricity.

* The country's 104 nuclear reactors produced 807 billion kWh in 2010, over 20% of total electrical output.

* Following a 30-year period in which few new reactors were built, it is expected that 4-6 new units may come on line by 2020, the first of those resulting from 16 licence applications made since mid-2007 to build 24 new nuclear reactors.

* However, lower gas prices since 2009 have put the economic viability of some of these projects in doubt.

* Government policy changes since the late 1990s have helped pave the way for significant growth in nuclear capacity. Government and industry are working closely on expedited approval for construction and new plant designs.

Note in the US electricity generation is driven purely by commercial considerations. And thus it's gas prices (more details later in this post) which has put dampner on new nuclear builds and not some deep, ethical dilemma among the leaders of the US of A as one brilliant poster here is trying to portray. But it's also useful to remember that low gas prices is/will be a transient phenomenon and US is benefiting from that due to some peculiarities of its geographic location.

In 2010, the US electricity generation was 4361 billion kWh gross, 46% of it from coal-fired plant, 23% from gas, 19% nuclear and 6.5% from hydro. Annual electricity demand is projected to increase to 5,000 billion kWh in 2030, though in the short term it is depressed and is not expected to recover to the 2007 level until about 2015. Annual per capita electricity consumption is currently around 12,400 kWh. Total capacity is 1027 GWe, less than one tenth of which is nuclear.

The USA has 104 nuclear power reactors in 31 states, operated by 30 different power companies. In 2009 these plants achieved a capacity factor of 91.1%, generating 799 billion kWh and accounting for 20% of total electricity generated. In 2010, 839 billion kWh gross (807 billion kWh net) was generated by nuclear plant.

There are 69 pressurized water reactors (PWRs) with combined capacity of about 67 GWe and 35 boiling water reactors (BWRs) with combined capacity of about 34 GWe – for a total capacity of 101,263 MWe (see Nuclear Power in the USA Appendix 1: US Operating Nuclear Reactors). Almost all the US nuclear generating capacity comes from reactors built between 1967 and 1990. There have been no new construction starts since 1977, largely because for a number of years gas generation was considered more economically attractive and because construction schedules were frequently extended by opposition, compounded by heightened safety fears following the Three Mile Island accident in 1979. A further PWR – Watts Bar 2 – is expected to start up by 2013 following Tennessee Valley Authority's (TVA's) decision in 2007 to complete the construction of the unit.

Despite a near halt in new construction of more than 30 years, US reliance on nuclear power has continued to grow. In 1980, nuclear plants produced 251 billion kWh, accounting for 11% of the country's electricity generation. In 2008, that output had risen to 809 billion kWh and nearly 20% of electricity, providing more than 30% of the electricity generated from nuclear power worldwide. Much of the increase came from the 47 reactors, all approved for construction before 1977, that came on line in the late 1970s and 1980s, more than doubling US nuclear generation capacity. The US nuclear industry has also achieved remarkable gains in power plant utilisation through improved refuelling, maintenance and safety systems at existing plants.

All the data and numbers have been discussed here but nevertheless IMO it's useful to have them in one place for reference.

While there are plans for a number of new reactors (see section on Preparing for new build below), the prospect of low natural gas prices continuing for several years has dampened these plans and probably no more than four new units will come on line by 2020.

So again its gas price

at this point of time, meaning commercial considerations, which has slowed things down. To extrapolate that to say that the US nuclear industry is "stalled" and will wither away, takes a special type of "genius".

Today the importance of nuclear power in USA is geopolitical as much as economic, reducing dependency on imported oil and gas. The operational cost of nuclear power – 1.87 ¢/kWh in 2008 – is 68% of electricity cost from coal and a quarter of that from gas.

From 1992 to 2005, some 270,000 MWe of new gas-fired plant was built, and only 14,000 MWe of new nuclear and coal-fired capacity came on line. But coal and nuclear supply almost 70% of US electricity and provide price stability. When investment in these two technologies almost disappeared, unsustainable demands were placed on gas supplies and prices quadrupled, forcing large industrial users of it offshore and pushing gas-fired electricity costs towards 10 ¢/kWh.

The reason for investment being predominantly in gas-fired plant was that it offered the lowest investment risk. Several uncertainties inhibited investment in capital-intensive new coal and nuclear technologies. About half of US generating capacity is over 30 years old, and major investment is also required in transmission infrastructure. This creates an energy investment crisis which was recognised in Washington, along with an increasing bipartisan consensus on the strategic importance and clean air benefits of nuclear power in the energy mix.{A point that many posters here, including myself, have raised here in the Indian context - only to be shouted away! Sigh!}

The Energy Policy Act 2005 then provided a much-needed stimulus for investment in electricity infrastructure including nuclear power. New reactor construction is expected to get under way from about 2012.

There are three regulatory initiatives which enhance the prospects of building new plants in the next few years. First is the design certification process, second is provision for early site permits (ESPs) and third is the combined construction and operating licence (COL) process. All have some costs shared by the DOE.

One final point: This data is available via four clicks. Makes you wonder, doesn't it, when folks come up with weird theories and hypothesis.